The search for a secure and dependable platform is critical in the ever-changing world of international money transfers. Currencies Direct, a major player in the industry, has been in operation for over two decades. However, the question remains: is Currencies Direct safe? (Short answer: Yes, Currencies Direct is safe). This thorough examination aims to provide an in-depth examination of the company’s security measures, track record, and regulatory compliance. By the end, you should have a better understanding of the platform’s reliability and suitability for your currency exchange needs.

Currencies Direct, founded in 1996, is a pioneer in the money transfer industry, having facilitated transactions for millions of clients worldwide. The company’s longevity is undoubtedly an indicator of its dependability; however, assessing its safety requires a deeper dive into its practices. In the sections that follow, we’ll look at the key factors that contribute to the platform’s security and dependability.

Currencies Direct is first and foremost authorized and regulated by various financial authorities. It operates in the United Kingdom under the strict supervision of the Financial Conduct Authority (FCA). Furthermore, the company is registered with the Financial Crimes Enforcement Network (FinCEN) in the United States and is regulated by the South African Reserve Bank (SARB), among other jurisdictions. These regulatory bodies ensure that Currencies Direct follows strict guidelines, is transparent, and follows anti-money laundering (AML) and know-your-customer (KYC) protocols.

Currencies Direct Accreditations

| Country | Accreditation & Explanation |

|---|---|

| United Kingdom | FCA (Financial Conduct Authority) – Currencies Direct is authorized as an Electronic Money Institution (EMI) by the FCA, ensuring that it adheres to strict regulations and guidelines related to financial services, safeguarding clients’ funds, and maintaining transparency. |

| European Union | FCA (Financial Conduct Authority) – As an EMI authorized by the FCA, Currencies Direct is also permitted to offer its services across the European Union (EU) under the Electronic Money Directive and Payment Services Directive, following the same stringent regulations as in the UK. |

| South Africa | FSB (Financial Services Board) – Currencies Direct South Africa (Pty) Ltd is an authorized Financial Services Provider (FSP) regulated by the FSB. This accreditation ensures compliance with South African financial regulations and consumer protection standards. |

| Spain | CNMV (Comisión Nacional del Mercado de Valores) – Currencies Direct is registered with the Spanish financial regulator CNMV, ensuring compliance with local regulations and maintaining the security and transparency of its operations in Spain. |

| Canada (British Columbia) | FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) – Currencies Direct is registered with FINTRAC as a Money Services Business (MSB), ensuring compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations in Canada. |

| Canada (Ontario) | FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) – Currencies Direct is registered with FINTRAC as a Money Services Business (MSB) in Ontario, ensuring compliance with AML and CTF regulations in the province. |

| United States | FinCEN (Financial Crimes Enforcement Network) – Currencies Direct is registered with FinCEN as a Money Services Business (MSB), ensuring compliance with federal AML and CTF regulations in the United States. Additionally, it is licensed as a Money Transmitter in various states. |

| India | RBI (Reserve Bank of India) – Currencies Direct is registered with the Reserve Bank of India as an Authorized Dealer Category II, allowing it to provide foreign exchange services in India and ensuring compliance with the country’s financial regulations. |

Currencies Direct Credit Rating

Another important factor contributing to Currencies Direct’s safety is its financial stability. As an established industry institution, the company has established a solid financial foundation, ensuring that it can handle large transactions with minimal disruption. Furthermore, Currencies Direct uses segregated client accounts, which means your funds are kept separate from the company’s own accounts. This practice protects your money in the unlikely event of financial difficulties or insolvency, adding an extra layer of protection.

Dun & Bradstreet (D&B) is a well-known international credit rating agency that provides credit scores and ratings to companies worldwide. Currencies Direct does not have a credit rating from a major credit rating agency, such as Moody’s, Standard & Poor’s, or Fitch Ratings, but it does have a credit profile with Dun & Bradstreet.

Dun & Bradstreet assigns a D-U-N-S® Number, a unique nine-digit identifier for businesses that is used to keep up-to-date and accurate information on millions of businesses around the world. Businesses, lenders, and suppliers can use the D-U-N-S Number to access a company’s credit information and assess its financial stability.

The D-U-N-S Number for Currencies Direct is 22-069-9820. While the specifics of their Dun & Bradstreet credit rating are not publicly available, having a D-U-N-S Number is a positive indicator of the company’s commitment to transparency and engagement with the global business community.

Currencies Direct’s financial stability can be measured in addition to their D-U-N-S Number by their strict regulatory compliance, membership in the prestigious Ebury Partners group, and use of segregated client accounts. All of these factors contribute to Currencies Direct’s solid reputation and dependability in the international money transfer industry.

Website Security

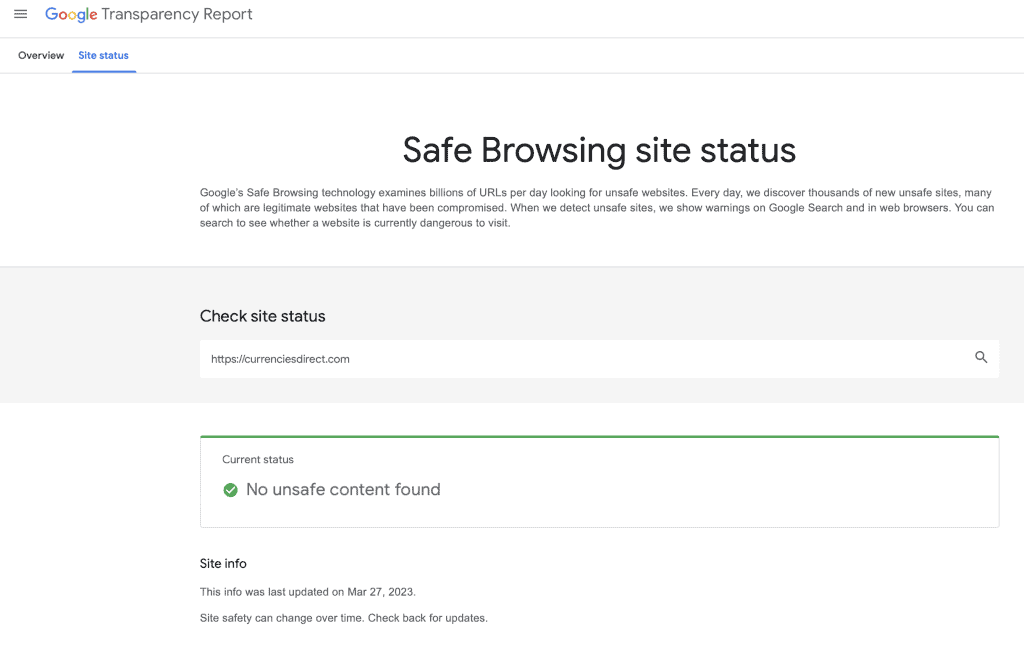

Currencies Direct Website is 100% Secure

The technological infrastructure of the platform is also critical in determining its safety. Currencies Direct uses cutting-edge technology to safeguard sensitive customer information and transactions against potential cyber threats. To protect data transmission between your device and their servers, the company employs advanced encryption technologies such as Secure Sockets Layer (SSL). Furthermore, Currencies Direct invests continuously in its IT infrastructure to ensure compliance with the most recent security protocols and standards.

Using Google’s Safe Blowing site status we can see that Currencies Direct website passes the test.

Is Currencies Direct Legit? Read User Reviews

Customer service and service quality are also indicators of a safe and dependable money transfer platform. Currencies Direct has a strong track record in this area, with numerous positive customer reviews and testimonials from across the web.

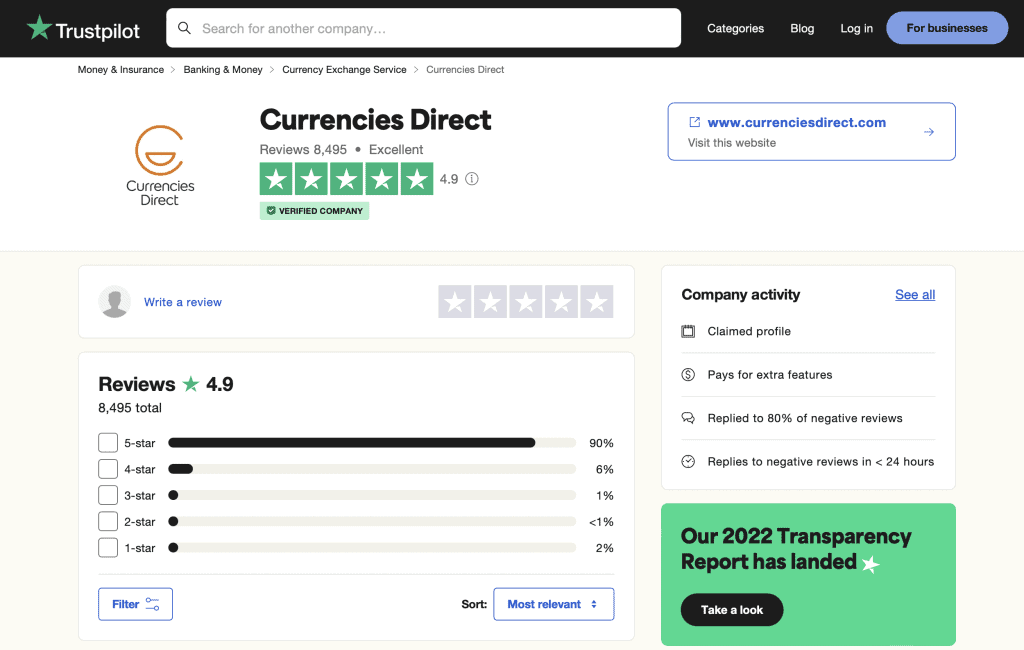

Currencies Direct is Safe: Reviews on Trustpilot

On Trustpilot, Currencies direct is rated 4.9/5.

As of 27 March 2023, there are more than 8,000 reviews of the company with 90% of clients rating their services as Excellent.

Their dedication to providing exceptional customer service is demonstrated by their dedicated account managers, who assist clients in navigating the often-complex world of international money transfers. This personalized approach not only facilitates a seamless experience, but it also contributes to the platform’s overall safety and reliability. Trust is established when clients feel confident in their interactions with the company, reinforcing the perception of security.

Transparency is another factor that gives Currencies Direct credibility. The company communicates its fees and exchange rates clearly, ensuring that customers are aware of the costs associated with their transactions. This transparency demonstrates the company’s dedication to ethical business practices, which contributes to its safety and credibility.

Currencies Direct Awards

In addition to the factors mentioned above, it’s worth considering Currencies Direct’s awards and accolades over the years. The company has received numerous industry awards for its services, innovation, and customer satisfaction, and has been consistently recognized for its excellence in the international money transfer space. These accomplishments demonstrate the company’s commitment to upholding high safety and reliability standards.

| Year | Award & Description |

|---|---|

| 2016 | Money Transfer Provider of the Year at the Consumer Moneyfacts Awards – Recognized for excellent customer service, competitive exchange rates, and transparent fee structure. |

| 2017 | Money Transfer Provider of the Year at the Consumer Moneyfacts Awards – Awarded for the second consecutive year, acknowledging the company’s commitment to customer satisfaction and value. |

| 2018 | Best Money Transfer Provider at the OPWA (Overseas Property Professional) Awards – Recognized for its services tailored to overseas property buyers, including dedicated account managers and support for property transactions. |

| 2019 | Money Transfer Provider of the Year at the Consumer Moneyfacts Awards – Honored for the third time in four years for its exceptional service, competitive pricing, and focus on customer needs. |

| 2020 | Best Money Transfer Provider at the British Banking Awards – Recognized for its outstanding service, user-friendly platform, and commitment to offering cost-effective solutions for international money transfers. |

| 2021 | Most Recommended Money Transfer Provider at the MoneyAge Awards – Acknowledged for its excellent customer service, user satisfaction, and strong reputation within the industry. |

To put Currencies Direct’s security measures into context, compare it to other money transfer providers. While the company’s security protocols and regulatory compliance are similar to those of its competitors, it distinguishes itself through its longevity and extensive industry experience. Furthermore, Currencies Direct distinguishes itself from many other platforms by providing personalized customer service and transparent pricing structures.

However, no money transfer service, including Currencies Direct, can guarantee complete security. Despite the company’s extensive security measures and regulatory compliance, clients must remain vigilant and exercise caution when conducting online transactions. Make sure you’re using a secure internet connection and keep your login information private. Furthermore, keep up to date on potential scams and phishing attempts, as cybercriminals are constantly devising new ways to exploit unsuspecting victims.

Frequently Asked Questions

Is Currencies Direct a Scam?

Currencies Direct is not a scam. It is a well-known and reputable money transfer company that has been in business since 1996. Currencies Direct has earned the trust of customers all over the world with over two decades of experience. Various financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom, have authorized and regulated the company. To ensure the safety of their clients’ funds, they maintain stringent security measures and follow industry best practices. Thousands of positive customer reviews and a slew of industry awards add to their credibility and dependability in the money transfer industry.

Conclusion

Finally, Currencies Direct has established itself as a secure and trustworthy platform for Discover if Currencies Direct is safe for your money transfers. Learn about their global accreditations, regulations, and commitment to security.international money transfers. The company’s regulatory compliance, financial stability, cutting-edge security protocols, and commitment to customer service all contribute to its credibility. Furthermore, it distinguishes itself from many of its competitors due to its transparency, industry accolades, and extensive experience in the money transfer space.

However, keep in mind that no service can guarantee complete security, and clients must take personal responsibility for their online security. Customers can improve the security of their transactions with Currencies Direct by remaining vigilant and following best practices.

With the information provided in this analysis, you should now have a better understanding of Currencies Direct’s safety and reliability as a money transfer platform. If the company’s security measures and practices meet your standards, it could be a good fit for your international currency exchange needs.