As an expat who has lived and worked in various countries over the years, I understand the importance of finding a reliable and affordable international money transfer service. Whether it’s sending money to family and friends back home, paying bills in a foreign country, or simply managing finances across borders, having access to a trustworthy money transfer service provider can make a world of difference.

Over the years, I’ve tried and tested numerous money transfer services, each with its own strengths and weaknesses. Some have offered low fees but slow delivery times, while others have been speedy but expensive. Through trial and error, I’ve come up with a list of the best 10 international money transfer services that I trust and recommend.

In this guide, I’ll be sharing my personal experiences and insights into each of these services, including their fees, delivery times, ease of use, and overall reliability. Whether you’re a seasoned expat or just starting out on your international journey, this article will provide you with valuable information and help you make informed decisions when it comes to sending and receiving money across borders.

How We Rank Money Transfer Services

Over the years, I have used several different services to send and receive money across borders, and I have developed a set of criteria to help me evaluate and compare these services. In my experience, there are five key factors that determine the quality of an international money transfer service: speed, cost, security, convenience, and customer support. By considering these factors and weighing them against my individual needs and priorities, I am able to make informed decisions about which services to use for my international money transfers.

- Speed of Transaction: One of the most important criteria for ranking international money transfer services is the speed at which transactions are processed. Customers want their money to arrive quickly, and providers that offer near-instantaneous transfers will rank higher than those with longer processing times.

- Cost and Fees: Another important factor is the cost of the service, which includes fees, exchange rates, and other charges. Providers that offer competitive pricing and transparent fee structures will be ranked higher.

- Security and Reliability: Customers want to be assured that their money is safe during the transfer process. Providers that use secure technologies and have a reputation for reliability will rank higher.

- Convenience and Accessibility: The convenience of the service is also important, and providers that offer multiple payment options, including online transfers, mobile apps, and in-person transfers, will rank higher. The accessibility of the service, including the number of countries and currencies supported, will also be taken into account.

- Customer Support: Lastly, good customer support is essential for any international money transfer service. Providers that offer responsive and helpful customer service, including multiple channels of communication, will rank higher.

| Review Criteria | Description |

|---|---|

| ⏱️ Speed of Transaction | Services with fast transaction processing times rank higher. |

| 💰 Cost and Fees | Providers that offer competitive and transparent pricing structures are preferred. |

| 🔒 Security and Reliability | Services using secure technologies and demonstrating a strong reliability reputation are favored. |

| 🌐📲 Convenience and Accessibility | Providers offering multiple payment options and supporting numerous countries/currencies are preferred. |

| 📞💬 Customer Support | Providers with responsive, helpful customer service across multiple channels are given a higher ranking. |

| Money Transfer Provider | Trustpilot Rating | Minimum Transfer Amount | Maximum Transfer Amount (Single Transfer) | Transfer Fees | Transfer Speed |

|---|---|---|---|---|---|

| Currencies Direct | 4.9/5 | £100 | No Limit | £0 | 1-3 business days |

| XE Money Transfer | 4.2/5 | £1 | £500,000 | £0 | 1-4 business days |

| OFX | 4.2/5 | £100 | No Limit | £0 – £15 | 1-2 business days |

| Wise | 4.4/5 | £1 | £1,000,000 | Low and transparent fees | 0-2 business days |

| Send Payments | 4.9/5 | £1 | £250,000 | £0 | 1-2 business days |

| TorFX | 4.9/5 | £100 | No Limit | £0 | 1-2 business days |

| CurrencyFair | 4.3/5 | €8 | €500,000 | €3 – €8 | 1-2 business days |

| Key Currency | 4.9/5 | £10,000 | £5,000,000 | No Fees | 1-2 business days |

| Clear Currency | 4.8/5 | £1 | No Limit | £0 – £10 | 1-2 business days |

| Global Reach | 2.7/5 | £1,000 | No Limit | No Fees | 1-2 business days |

Top 10 International Money Transfer Companies for 2023

- Currencies Direct

- XE Money Transfer

- OFX

- Wise

- Send Payments

- TorFX

- CurrencyFair

- Key Currency

- Clear Currency

- Global Reach

1. Currencies Direct (Best Overall)

Currencies Direct is a top-rated international money transfer company that has earned our recommendation for several reasons. With over 20 years of experience in the industry, Currencies Direct has built a reputation for providing reliable and efficient international money transfer services to individuals and businesses around the world.

One of the key factors that sets Currencies Direct apart is their commitment to transparency and competitive pricing. Unlike many other money transfer companies, Currencies Direct offers a price-match guarantee, which means that they will match any quote from a competitor that offers a similar service. This ensures that customers always get the best possible deal and are not subjected to hidden fees or unfavorable exchange rates.

In addition to their competitive pricing, Currencies Direct also offers a fast and efficient transfer process. Most transfers can be completed within one to two business days, which is faster than many other providers in the market. Customers can also choose from a variety of payment options, including bank transfers, debit cards, and credit cards, making it easy and convenient to send and receive money across borders.

Currencies Direct also places a strong emphasis on customer support, with a team of knowledgeable and responsive representatives available to assist customers at any time. They offer 24/7 support via phone, email, and live chat, as well as a dedicated account manager for larger transactions.

Overall, Currencies Direct is an excellent choice for anyone looking for a reliable, efficient, and transparent international money transfer service. With competitive pricing, fast transfers, and excellent customer support, they have earned our top recommendation.

Pros:

- Competitive pricing: Currencies Direct offers a price-match guarantee, which means that they will match any quote from a competitor that offers a similar service. This ensures that customers always get the best possible deal and are not subjected to hidden fees or unfavorable exchange rates.

- Fast transfers: Currencies Direct provides fast and efficient transfer processing. Most transfers can be completed within one to two business days, which is faster than many other providers in the market.

- Multiple payment options: Currencies Direct provides a variety of payment options, including bank transfers, debit cards, and credit cards, making it easy and convenient to send and receive money across borders.

- Excellent customer support: Currencies Direct has a team of knowledgeable and responsive representatives available to assist customers at any time. They offer 24/7 support via phone, email, and live chat, as well as a dedicated account manager for larger transactions.

- User-friendly online platform: Currencies Direct offers a user-friendly online platform that allows customers to manage their transfers and payments easily.

Cons:

- Limited currency options: Currencies Direct supports a limited number of currencies compared to some of its competitors. This may not be an issue for customers who only need to transfer money in popular currencies, but it can be a disadvantage for those who require less common currencies.

- High minimum transfer amount: Currencies Direct has a relatively high minimum transfer amount, which may not be suitable for customers who only need to send small amounts of money.

- No cash pickup option: Currencies Direct does not offer cash pickup options, which may be inconvenient for customers who prefer to receive their money in cash.

- Limited geographical coverage: Currencies Direct has limited geographical coverage, which means that they may not be available in certain countries or regions. This can be a disadvantage for customers who need to send money to or receive money from countries where Currencies Direct does not operate.

To learn more read our comprehensive review of Currencies Direct.

2. XE Money Transfer (Runner Up)

XE Money Transfer is an established and trusted international money transfer company that offers competitive pricing, a wide range of currencies, and a user-friendly platform. While it did not take the top spot on our ranking, it is still a highly recommended option for customers who want a reliable and efficient service.

One of the main strengths of XE Money Transfer is its competitive exchange rates, which can result in significant savings for customers. The company offers transparent pricing with no hidden fees, and customers can see the exact exchange rate they will receive before making a transfer. Additionally, XE Money Transfer supports over 130 currencies, making it a great option for customers who need to transfer money in less common currencies.

XE Money Transfer also has a user-friendly online platform that allows customers to manage their transfers and payments easily. The platform is intuitive and easy to navigate, and customers can set up recurring payments or track their transfer history with just a few clicks. Additionally, XE Money Transfer offers excellent customer support, with a team of knowledgeable and friendly representatives available to assist customers at any time.

One area where XE Money Transfer could improve is its transfer times, which can be slower than some other providers. Some transfers can take up to five business days to complete, which may not be suitable for customers who need to send money urgently. Additionally, XE Money Transfer only accepts bank transfers as a payment option, which may not be convenient for customers who prefer to use debit or credit cards.

Overall, XE Money Transfer is a highly recommended option for customers who want a reliable and efficient international money transfer service with competitive pricing and a wide range of currencies. While it may not be the top-ranked provider on our list, it still offers a great overall package and is a trustworthy choice for customers.

Pros:

- Competitive exchange rates: XE Money Transfer offers competitive exchange rates, which can result in significant savings compared to other providers.

- No transfer fees: XE Money Transfer does not charge any transfer fees, which can make it an attractive option for customers who want to save on costs.

- Wide range of currencies: XE Money Transfer supports over 130 currencies, which is more than many other providers. This can be an advantage for customers who need to transfer money in less common currencies.

- High maximum transfer amount: XE Money Transfer has a relatively high maximum transfer amount, which can be a benefit for customers who need to transfer millions of dollars.

- User-friendly online platform: XE Money Transfer offers a user-friendly online platform that allows customers to manage their transfers and payments easily.

Cons:

- Slow transfer times: XE Money Transfer’s transfer times can be slower than some other providers, with some transfers taking up to five business days to complete.

- Limited payment options: XE Money Transfer only accepts bank transfers, which may not be convenient for customers who prefer to use debit or credit cards.

- No cash pickup option: XE Money Transfer does not offer cash pickup options, which may be inconvenient for customers who prefer to receive their money in cash.

- Limited customer support: XE Money Transfer’s customer support is limited to phone and email, with no live chat or 24/7 support available. This can be a disadvantage for customers who need immediate assistance or prefer multiple channels of communication.

To learn more read our comprehensive review of XE Money Transfer.

3. OFX

OFX is a global money transfer service that offers fast, secure and affordable international transfers for individuals and businesses. Founded in 1998 in Sydney, Australia, the company has since expanded its operations to include offices in North America, Europe and Asia Pacific, and has helped more than 1 million customers transfer over $100 billion worldwide.

With a focus on transparency and customer service, OFX offers competitive exchange rates and low fees on its transfers. The company operates on a transparent pricing model, where customers can easily calculate the cost of their transfers online, and there are no hidden fees or charges.

OFX also offers a range of transfer options to suit different needs, including one-off transfers, recurring payments, and forward contracts. Its online platform is user-friendly and accessible, allowing customers to track their transfers and view their transaction history at any time.

In terms of security, OFX is regulated by financial authorities in multiple jurisdictions, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. The company also employs robust security measures to protect customer data and transactions, including 128-bit SSL encryption and two-factor authentication.

Overall, OFX stands out among international money transfer services for its competitive pricing, user-friendly platform, and commitment to customer service and security. Whether you’re an individual or a business looking to transfer money overseas, OFX is a reliable and trustworthy option to consider.

Pros:

- Competitive exchange rates: OFX offers highly competitive exchange rates for international money transfers, which means that customers can save money compared to traditional banks and other transfer services.

- Low fees: OFX charges low transfer fees, which can also save customers money compared to other transfer services that charge higher fees.

- User-friendly platform: OFX’s online platform is easy to use and provides customers with real-time exchange rates and transaction tracking, making it a convenient option for international money transfers.

- Range of transfer options: OFX offers a variety of transfer options, including one-off transfers, recurring payments, and forward contracts, which provides flexibility for customers.

- Regulated and secure: OFX is regulated by financial authorities in multiple jurisdictions and employs robust security measures to protect customer data and transactions.

Cons:

- Transfer limits: OFX has minimum and maximum transfer limits, which may not suit everyone’s needs, especially for larger transactions.

- No cash transfers: OFX does not offer cash transfers, which may be a drawback for some customers who prefer this option.

- Limited currency options: Although OFX supports a wide range of currencies, there are some less common currencies that it does not support, which may be a limitation for some customers.

- No in-person support: OFX does not have physical branches or offer in-person support, which may be a disadvantage for customers who prefer face-to-face interactions.

- Longer transfer times: While OFX offers fast transfers, it may take longer than some other services for the money to reach the recipient’s account, especially for larger amounts or less common currency routes.

For more information make sure to read our full review of OFX.

4. Wise (formally TransferWise)

Wise, formerly known as TransferWise, is an online money transfer service that has revolutionized the way people send and receive money internationally. Founded in 2011 by two friends, Taavet Hinrikus and Kristo Käärmann, who experienced the frustration of costly and time-consuming traditional bank transfers, Wise has since grown to become one of the most trusted and popular money transfer services globally.

One of the standout features of Wise is its transparent and low-cost pricing. Wise offers its customers the real exchange rate, without any hidden fees or markups. This means that users can transfer money internationally without having to worry about hidden fees or unexpected charges. Wise also offers a simple and easy-to-use platform, making the process of transferring money quick and hassle-free.

Another advantage of Wise is its global reach, with over 80 countries supported and 40+ currencies available for transfer. The service also offers several payment methods, including bank transfers, credit/debit cards, and local payment options like SOFORT, iDEAL, and Apple Pay.

Wise’s innovative technology enables it to offer some of the best exchange rates in the market, making it an excellent option for smaller transfers. For example, if you need to send a smaller amount of money to a friend or family member overseas, Wise can save you a significant amount of money compared to traditional bank transfers or other money transfer services.

Overall, Wise is an excellent option for anyone looking for a reliable, low-cost, and user-friendly international money transfer service. Its transparent pricing, global reach, and innovative technology make it one of the best choices for smaller transfers, and it’s definitely worth considering for your next international money transfer.

Pros:

- Low-cost and transparent pricing: Wise offers users the real exchange rate, without any hidden fees or markups, making it one of the most affordable options for international money transfers.

- Quick and easy transfers: Wise’s platform is user-friendly and straightforward, enabling users to send and receive money quickly and easily.

- Global reach: Wise supports over 80 countries and 40+ currencies, making it an excellent option for international transfers to a wide range of destinations.

- Flexible payment options: Wise supports a variety of payment methods, including bank transfers, credit/debit cards, and local payment options like SOFORT, iDEAL, and Apple Pay.

- Safety and security: Wise is a licensed and regulated financial institution, meaning that users’ funds are held securely and protected by financial regulations.

Cons:

- Limited cash transfer options: Wise does not support cash transfers, so users will need to have a bank account or a card to use the service.

- Transfer limits: Wise has daily and monthly transfer limits, which may not be sufficient for larger transactions.

- Transfer speed: While Wise transfers are generally quick, they may take longer than some other money transfer services, particularly for larger transactions or in less popular currency routes.

- Limited customer support: Wise primarily provides customer support via email, which may not be as convenient or responsive as phone or chat support.

5. Send Payments

Send Payments is an international money transfer service that offers a range of options for sending and receiving money globally. With its headquarters in Australia, Send Payments is an excellent choice for clients based in Australia and New Zealand who need to transfer money internationally.

One of the standout features of Send Payments is its competitive exchange rates, which are often better than those offered by traditional banks. The service offers real-time exchange rates, with no hidden fees or markups, enabling users to transfer money at the best possible rate. Send Payments also offers a range of payment options, including bank transfers and credit/debit card payments.

Another advantage of Send Payments is its user-friendly platform, which makes the process of transferring money simple and hassle-free. Users can easily track the progress of their transfers and receive notifications once the funds have been received by the recipient.

Send Payments also offers several security measures to protect users’ funds, including SSL encryption, two-factor authentication, and anti-fraud protection. The service is licensed and regulated by the Australian Securities and Investments Commission (ASIC), providing users with peace of mind that their funds are secure.

However, there are some limitations to Send Payments. The service currently only supports 20 currencies, which may not be sufficient for some users who require more exotic currency options. Additionally, Send Payments is not available in all countries, so users should check if the service is available in their location before signing up.

Overall, Send Payments is an excellent choice for clients based in Australia and New Zealand who need to transfer money internationally. Its competitive exchange rates, user-friendly platform, and robust security measures make it a reliable and convenient option for international money transfers.

Pros:

- Competitive exchange rates: Send Payments offers real-time exchange rates, which are often better than those offered by traditional banks. Users can transfer money at the best possible rate with no hidden fees or markups.

- User-friendly platform: Send Payments’ platform is easy to use and navigate, making the process of transferring money quick and hassle-free.

- Flexible payment options: Send Payments offers a range of payment options, including bank transfers and credit/debit card payments.

- Secure: Send Payments uses SSL encryption, two-factor authentication, and anti-fraud protection to ensure the safety of users’ funds. The service is also licensed and regulated by the Australian Securities and Investments Commission (ASIC).

- Fast transfers: Send Payments offers fast transfer times, with some transfers being completed within minutes.

Cons:

- Limited currency options: Send Payments currently only supports 20 currencies, which may not be sufficient for users who require more exotic currency options.

- Not available in all countries: Send Payments is not available in all countries, so users should check if the service is available in their location before signing up.

- Fees for some transactions: While Send Payments does not charge hidden fees or markups, there may be fees associated with some transactions, such as credit card payments.

- Limited customer support: Send Payments primarily provides customer support via email, which may not be as convenient or responsive as phone or chat support.

6. TorFX

TorFX is a leading international money transfer service that specializes in providing competitive currency exchange solutions to individuals and businesses around the world. Founded in 2004 in the UK, the service has established a reputation for providing reliable, cost-effective, and secure money transfer solutions.

One of the key features of TorFX is its focus on customer satisfaction. The service provides each customer with a dedicated account manager who can guide them through the transfer process and answer any questions they may have. TorFX also offers a range of transfer options, including spot contracts, forward contracts, and limit orders, to help users maximize the value of their transfers.

TorFX’s competitive exchange rates are another advantage of the service. The company offers a price match guarantee, ensuring that users receive the best possible exchange rates. The service also does not charge any transfer fees, making it a cost-effective option for users who need to transfer large sums of money.

In terms of security, TorFX takes a proactive approach to protecting its users’ funds. The service uses two-factor authentication, SSL encryption, and segregated client accounts to ensure that users’ funds are safe and secure. TorFX is also licensed and regulated by the Financial Conduct Authority (FCA) in the UK, providing users with an added layer of security.

Despite its UK roots, TorFX offers services to customers around the world. The company supports a range of currencies, including GBP, USD, EUR, AUD, and CAD, and provides users with access to a global network of banks and financial institutions. However, the service may not be available in all countries, so users should check TorFX’s website for availability.

In summary, TorFX is a reliable and convenient choice for individuals and businesses that require international money transfers. With its competitive exchange rates, exceptional customer service, and robust security measures, TorFX has established itself as a leading player in the money transfer industry.

Pros:

- Competitive exchange rates: TorFX offers highly competitive exchange rates for a wide range of currencies, often better than those offered by traditional banks.

- Dedicated account managers: Each TorFX user is assigned a dedicated account manager who provides guidance throughout the transfer process and is available to answer any questions.

- Range of transfer options: TorFX provides users with a range of transfer options, including spot contracts, forward contracts, and limit orders, to help them maximize the value of their transfers.

- No transfer fees: TorFX does not charge any transfer fees, making it a cost-effective option for users who need to transfer large sums of money.

- Robust security measures: TorFX uses industry-standard security measures, such as two-factor authentication, SSL encryption, and segregated client accounts, to protect users’ funds.

- Regulated by the FCA: TorFX is licensed and regulated by the Financial Conduct Authority (FCA) in the UK, providing users with an added layer of security.

Cons:

- Limited currency options: TorFX does not support as many currencies as some of its competitors, which may be a disadvantage for users who require more exotic currency options.

- Limited availability: TorFX is primarily focused on UK-based users, and its availability in other countries may be limited.

- No mobile app: TorFX does not have a mobile app, which may be an inconvenience for users who prefer to manage their transfers on-the-go.

- No instant transfers: TorFX transfers typically take 1-2 days to complete, which may be slower than some other money transfer services that offer instant transfers.

Read our in-depth review of TorFX.

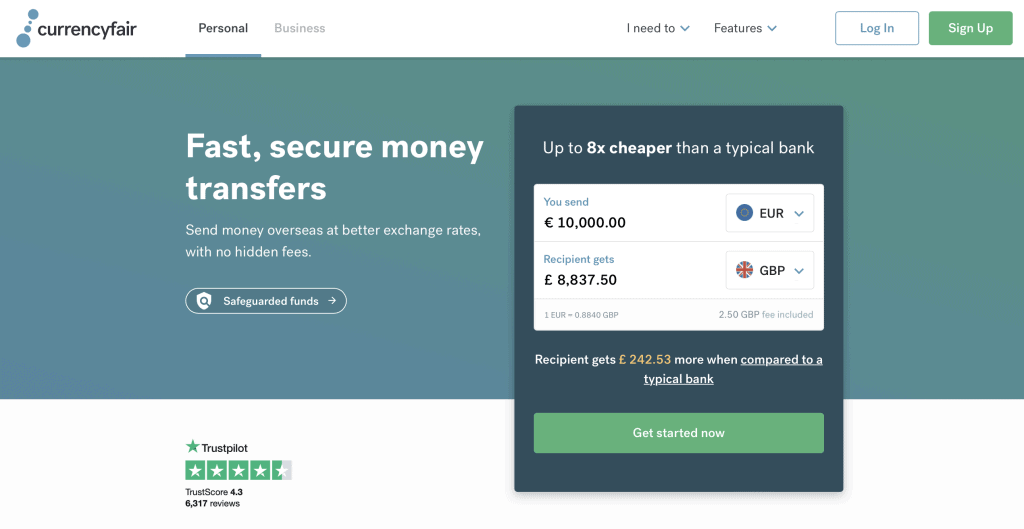

7. CurrencyFair

CurrnecyFair is a well-known international money transfer company that offers competitive rates and no hidden fees. Major financial institutions trust the platform, making it one of the most dependable money transfer companies available. CurrnecyFair now has over 300,000 customers in 190 countries. Over $20 billion in international transfers have been processed by the company, with an average transfer time of just 2-3 business days.

In addition, the company provides travel money services, currency exchange, and international payments. CurrnecyFair, in addition to its competitive rates, provides 24/7 customer support, making it one of the most convenient and dependable money transfer companies available. CurrnecyFair is one of the best international money transfer companies available today, thanks to its simple, user-friendly interface and competitive rates.

Pros:

- Competitive exchange rates: CurrencyFair offers competitive exchange rates, making it an excellent choice for customers looking to save money when transferring funds internationally.

- No hidden fees: CurrencyFair does not charge any hidden fees or commissions on transfers, making it a more cost-effective option than some of its competitors.

- Quick payments: Customers can expect quick payments from CurrencyFair, with an average transfer time of just 2-3 business days.

- Secure transfers: CurrencyFair has collaborated with major financial institutions to ensure the security of all transfers.

- 24 hour customer service: CurrencyFair provides 24 hour customer service, making it more convenient than some of its competitors.

- Easy-to-use interface: CurrencyFair has a simple, user-friendly interface that makes it simple to use for customers of all levels of experience.

- Provides currency exchange, travel money, and international payments: CurrencyFair also provides currency exchange, travel money, and international payments.

Cons:

- Limited currency selection: CurrencyFair offers transfers in a limited number of currencies, which may be inconvenient for some customers.

- Transfer limits can be restrictive: CurrencyFair has set transfer limits that some customers may find too restrictive making their service not ideal for large transfers.

8. Key Currency

Key Currency is a leading foreign exchange company based in the United Kingdom that offers tailored currency exchange services to both individuals and businesses. The company was founded in 2015 and has quickly grown to become an industry leader.

The customer-centric approach of Key Currency distinguishes it from its competitors. The company’s experienced currency specialists collaborate with clients to understand their specific currency needs and provide tailored solutions. Key Currency provides a wide range of currency-related products and services, such as forward contracts, spot transactions, and market orders, allowing clients to effectively manage their currency exposure.

Key Currency has exchanged over £1 billion in currencies since its inception and has a loyal client base of over 10,000 individuals and businesses. The company’s dedication to providing exceptional customer service has earned it industry recognition, including the Best Foreign Exchange Provider award at the 2020 British Bank Awards and a spot on the Moneyfacts Consumer Awards shortlist.

Key Currency, a regulated company authorized by the Financial Conduct Authority (FCA), offers transparent and trustworthy currency exchange services. Client funds are kept in separate accounts with top-tier banks, ensuring their security and protection.

The mission of Key Currency is to help clients save time and money on currency exchange transactions by providing personalised solutions, competitive rates, and expert knowledge. The company’s dedication to customer service and innovative approach make it an appealing option for anyone looking for a trustworthy currency exchange provider.

Pros:

- No fees: Key Currency does not charge any transfer fees.

- Competitive exchange rates: Key Currency offers competitive exchange rates.

- Personalized service: Key Currency provides a dedicated account manager to guide you through the process and answer any questions you may have. This personalized service can be particularly helpful if you are new to international money transfers.

- Fast transfer times: Key Currency offers fast transfer times, with most transfers completed within one to two business days.

- Very High Trustpilot rating: Key Currency has a high Trustpilot rating of 4.9/5, indicating that customers are generally satisfied with their service.

Cons:

- High minimum transfer amount: Key Currency has a relatively high minimum transfer amount of £10,000, which may not be suitable for everyone.

- Limited transfer options: Key Currency only offers bank-to-bank transfers, which may not be ideal if you prefer other payment methods such as debit or credit card payments.

- Limited global coverage: Key Currency does not offer transfers to all countries, so it may not be the best option if you need to send money to a country that they do not support.

- No mobile app: Key Currency does not offer a mobile app, which may be a disadvantage if you prefer to manage your transfers on-the-go.

9. Clear Currency

Clear Currency is a leading currency exchange and international payments provider that specializes in providing low-cost foreign exchange services to businesses and individuals all over the world. Since its inception in 2013 by two experienced financial professionals, the company has grown to become one of the market’s most reputable and trusted providers of foreign currency exchange services.

Clear Currency, headquartered in Dublin, Ireland, has a strong international presence, with offices in London and Spain. The mission of the company is to assist its clients in minimizing the costs and risks associated with international payments while providing exceptional customer service and support.

Clear Currency’s team of experienced currency experts has over 50 years of combined financial industry experience, and they work tirelessly to provide clients with the best currency exchange rates and services possible. The company has strong relationships with major banks and financial service providers around the globe, allowing it to provide competitive currency exchange rates to its clients.

Clear Currency, in addition to currency exchange services, provides a variety of other financial products and services, such as international money transfers, foreign currency accounts, and risk management solutions. The company’s online platform is simple to use and gives clients real-time access to currency exchange rates, allowing them to make educated decisions about international payments.

Pros:

- Competitive exchange rates: Clear Currency provides its clients with competitive exchange rates.

- No hidden fees: Clear Currency is upfront about its fees and charges, and there are no surprises when using its services.

- Fast transactions: Clear Currency’s online platform enables quick and efficient transfers.

- Secure transactions: Clear Currency employs cutting-edge security technology to safeguard its clients’ financial information and transactions, ensuring the safety of their funds.

- Excellent customer support: Clear Currency offers excellent customer service and support, with a team of currency experts on hand to assist clients with their currency exchange needs.

Cons:

- Limited Currency Options: When compared to other currency exchange providers, Clear Currency offers a limited range of currencies.

- No Physical Branches: Because Clear Currency is an online platform, clients cannot access physical branches for assistance or support.

- No forward contracts: Clear Currency does not provide forward contracts, which may be an issue for businesses that need to lock in exchange rates for future transactions.

10. Global Reach

Global Reach is a well-respected provider of international payment solutions and foreign exchange services, dedicated to helping businesses and individuals save money on currency transactions. With over 20 years of experience, the company has established itself as a key player in the global currency market and currently operates in more than 140 countries around the world.

Headquartered in London, Global Reach has a highly skilled workforce of over 150 employees, including specialists in currency exchange, risk management, and compliance. The company is committed to delivering top-quality service to its clients while offering cost-effective currency exchange solutions.

Global Reach caters to a diverse range of clients, including SMEs, corporations, financial institutions, and private individuals. Each year, the company processes over £3.5 billion in foreign currency transactions, boasting an impressive client retention rate of over 95%.

The company’s online platform, Global Reach GO, offers clients real-time access to currency exchange rates and market news, providing them with valuable insights to make informed decisions about their currency transactions. The platform is user-friendly and features a range of tools and resources to help clients manage currency risk.

Global Reach takes its responsibility to protect its clients’ security and privacy seriously and is regulated by the Financial Conduct Authority (FCA) in the UK. The company also holds ISO 27001 certification for information security and ISO 9001 certification for quality management.

In addition to its core currency exchange services, Global Reach also provides risk management solutions, international money transfers, and currency accounts to its clients. The company’s team of currency experts works closely with clients to help them manage currency risk and minimize the impact of exchange rate fluctuations on their finances.

Global Reach has received numerous accolades for its exceptional service and innovative technology, including Best FX Provider at the 2019 Business Moneyfacts Awards and Best FX Provider at the 2020 Moneyfacts Awards.

Pros:

- Cost-effective currency exchange solutions: Global Reach helps businesses and individuals save money on currency transactions.

- Wide range of financial products: Global Reach provides a variety of financial products in addition to currency exchange, such as risk management solutions, international money transfers, and currency accounts.

- Real-time access to currency exchange rates and market news: Global Reach GO, the company’s online platform, gives clients access to currency exchange rates and market news in real-time, allowing them to make informed decisions about their currency transactions.

- High level of security and compliance: Global Reach is regulated by the Financial Conduct Authority (FCA) in the United Kingdom and has ISO 27001 certification for information security and ISO 9001 certification for quality management.

- Exceptional service and support: Global Reach’s currency specialists work closely with clients to help them manage currency risk and reduce the impact of exchange rate fluctuations on their business or personal finances.

- Honors and awards: Global Reach has received numerous honors and awards for its exceptional service and innovative technology.

Cons:

- Limited physical presence: While Global Reach operates in over 140 countries around the world, it does not have a physical presence in all of them.

- Reliance on online platform: Global Reach GO is the company’s primary platform for currency exchange, which may not be suitable for clients who prefer traditional methods of conducting transactions.

- Fees and commissions: Like most currency exchange providers, Global Reach charges fees and commissions for its services.

Other Money Transfer Organizations

Whilst the following money transfer companies may not have made our top 10 list they are still worth an honourable mention due to their reputation and service offering.

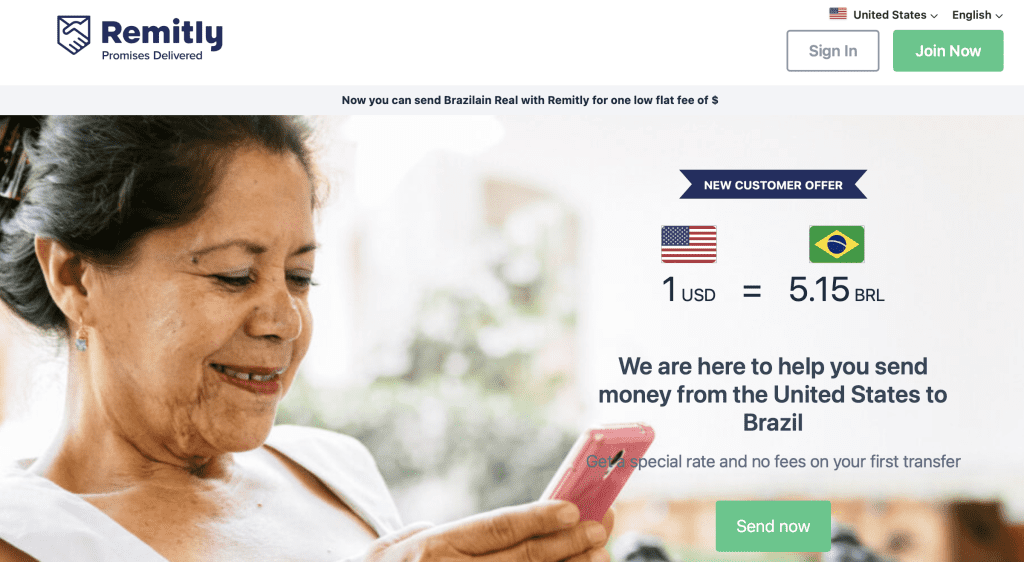

Remitly

Remitly is a US-based money transfer provider that specializes in international remittances. The company was founded in 2011 and is headquartered in Seattle, Washington. Remitly’s mission is to provide a fast, convenient, and secure way for people to send money to their loved ones in other countries.

As of 2021, Remitly has over 4 million customers worldwide and operates in over 20 countries. The company offers competitive exchange rates and charges a low fee for its services. Remitly’s online platform is user-friendly and allows customers to send money from their mobile devices or desktop computers.

Remitly takes security and privacy seriously, and employs industry-standard encryption and two-factor authentication to protect its customers’ data. The company also offers a money-back guarantee in case a transfer is not delivered on time or is canceled for any reason.

Overall, Remitly is a reliable and trustworthy option for anyone who needs to send money internationally. Its easy-to-use platform, competitive rates, and commitment to security make it a top choice for many customers around the world.

Pros:

- Fast transfers: Remitly offers fast transfer times, with some transactions able to be completed in as little as a few minutes.

- Competitive rates: Remitly’s exchange rates are typically competitive, meaning users can often get a better deal than they would with traditional banks or other transfer services.

- Wide coverage: Remitly covers a large number of countries, making it easy for users to send money to a wide range of locations.

- User-friendly: The platform is easy to use, with a simple interface and clear instructions.

Cons:

- Fees: Remitly charges fees for their services, which can vary depending on the country and transfer amount.

- Limited payment options: Remitly only accepts payment via debit or credit cards or bank accounts.

- Transfer limits: Remitly has limits on the amount of money users can send in a single transaction or over a certain period of time, which may be an issue for those needing to send larger sums.

- Customer service: Some users have reported issues with Remitly’s customer service, with difficulty reaching support and resolving issues in a timely manner.

Western Union

Western Union is a global leader in cross-border, cross-currency money movement and payment services. The company has been in operation for over 170 years and has a strong presence in over 200 countries and territories worldwide. Its mission is to assist individuals and businesses in moving money across borders, currencies, and channels in the most efficient, secure, and dependable manner possible.

Western Union provides a wide range of services, including person-to-person money transfers, business payments, and money orders. It also offers digital and mobile payment services to its customers, allowing them to send and receive money from the comfort of their own homes. The company is committed to providing its customers with fast, convenient, and affordable payment solutions, regardless of their location or financial situation.

Western Union had over 12,000 employees as of 2023 and reported revenues of more than $4.8 billion. The company processes an average of 29 transactions per second, with an annual transaction volume of more than $300 billion. Western Union’s customer base includes individuals, businesses, and non-profit organizations, with a focus on serving those who are underbanked or unbanked.

In addition to payment services, Western Union is dedicated to giving back to the communities it serves through various corporate social responsibility initiatives. The Ethisphere Institute named the company one of the most ethical in the world because of its strong commitment to diversity and inclusion.

Overall, Western Union is a trustworthy and dependable partner for individuals and businesses who need to transfer money across borders and currencies. Western Union is poised for continued growth and success in the years ahead, thanks to a long history of success and a commitment to innovation and social responsibility.

Pros:

- Excellent global coverage: Western Union has a global reach with over 550,000 agent locations in over 200 countries and territories, making it a convenient option for sending money almost anywhere in the world.

- Fast transfer times: Western Union provides quick transfer times, with some transactions completed in minutes, making it ideal for urgent payments.

- Accessibility: Western Union offers a variety of ways to send and receive money, including online, through an agent location, and through its mobile app.

- Security: Western Union protects your transactions with advanced encryption technology and provides fraud prevention measures such as identity and receiver information verification.

- Customer service: Western Union offers customer service 24 hours a day, seven days a week via phone, email, and live chat.

Cons:

- Fees: Western Union charges fees for its services, which can be higher than those charged by other money transfer services, particularly for larger amounts.

- Exchange rates: Western Union exchange rates may not be the best, and they may vary depending on the currency, country, and payment method used.

- Transfer limits: Transfer limits for Western Union vary depending on the country and service used, and these limits may be lower for new customers or those who have not verified their identity.

- Risk of fraud: Western Union, like any financial service, is vulnerable to fraud, and scammers may use its services to defraud unsuspecting individuals. Transfers may be delayed for security or compliance reasons on occasion, causing inconvenience and frustration for both the sender and receiver.

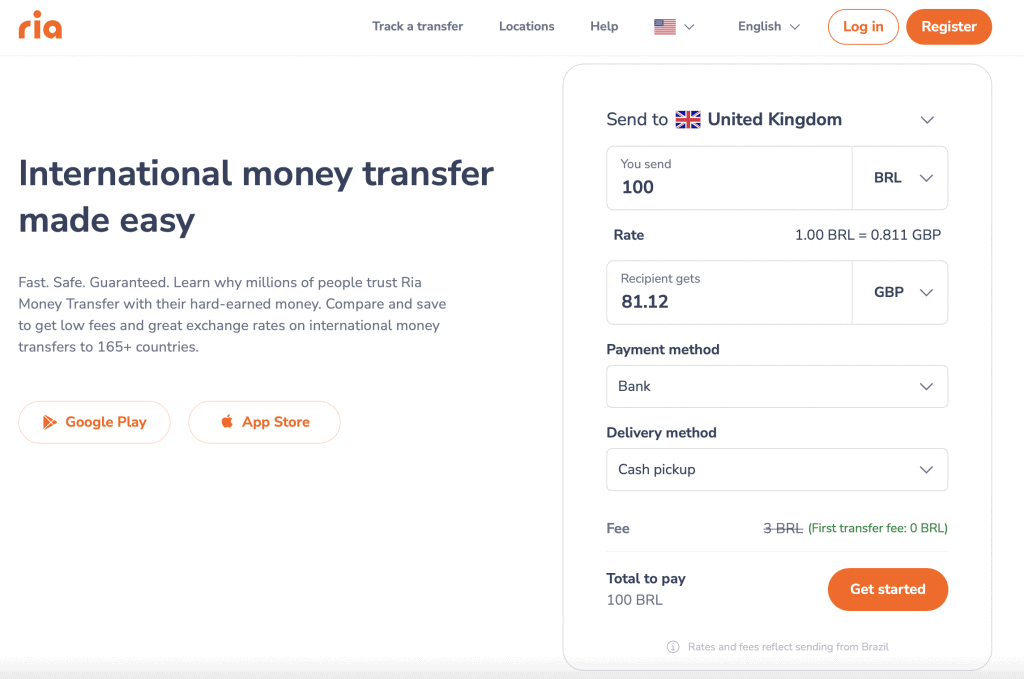

Ria Money Transfer

Ria Money Transfer is a leading global money transfer company that offers individuals, businesses, and financial institutions worldwide fast, secure, and affordable money transfer services. The company was established in 1987 and is based in California, USA.

Ria Money Transfer, with over 435,000 agent locations in more than 160 countries worldwide, provides a convenient and accessible way for customers to send and receive money globally. The company has also invested in its technology infrastructure, allowing customers to make payments via bank transfers, credit and debit card payments, and mobile money transfers.

Ria Money Transfer has a reputation for providing its customers with dependable and high-quality service. For its outstanding performance, the company has received several awards and recognitions, including the 2020 Best Money Transfer Company award at the Finder Awards and the 2019 Best Money Transfer Company award at the IAMTN Remittances Awards.

Ria Money Transfer, in addition to consumer money transfer services, provides a variety of services to financial institutions and businesses, such as white-label solutions, compliance and risk management services, and currency exchange services. To provide customers with more payment options and faster transfer times, the company has formed partnerships with leading financial institutions and payment processors.

Ria Money Transfer is dedicated to providing excellent customer service, with a dedicated team of professionals available 24 hours a day, seven days a week in multiple languages. The company also prioritizes corporate social responsibility, with initiatives aimed at promoting financial literacy and assisting local communities.

Ria Money Transfer is a leading global money transfer company that has transformed the way people send and receive money around the world. The company is poised to continue leading the money transfer industry for years to come, thanks to its extensive network, innovative technology, and commitment to customer service.

Pros:

- Extensive network: Ria Money Transfer has a global network of over 435,000 agent locations in over 160 countries, making it simple for customers to send and receive money around the world.

- Low fees: Ria Money Transfer charges competitive and affordable fees, which may be lower than those of its competitors.

- Quick transfer times: The company provides quick transfer times, with some transfers completed in minutes.

- Convenient payment methods: Ria Money Transfer offers a variety of payment methods to customers, including bank transfers, credit and debit card payments, and mobile money transfers, making it simple for customers to select the payment method that works best for them.

- Excellent reviews: Ria Money Transfer has a reputation for providing its customers with dependable and high-quality service.

Cons:

- Limited currency selection: Ria Money Transfer supports fewer currencies than some of its competitors, which can be a disadvantage for customers who need to send money to less popular locations.

- Fees vary by location: Ria Money Transfer’s fees may vary by location, making it difficult for customers to compare prices across different regions.

- Transfer amount restrictions: Ria Money Transfer places restrictions on the amount of money that can be transferred, which can be difficult for customers who need to transfer larger sums.

- Customer service availability: While Ria Money Transfer provides customer service in multiple languages, support may be limited in some regions.

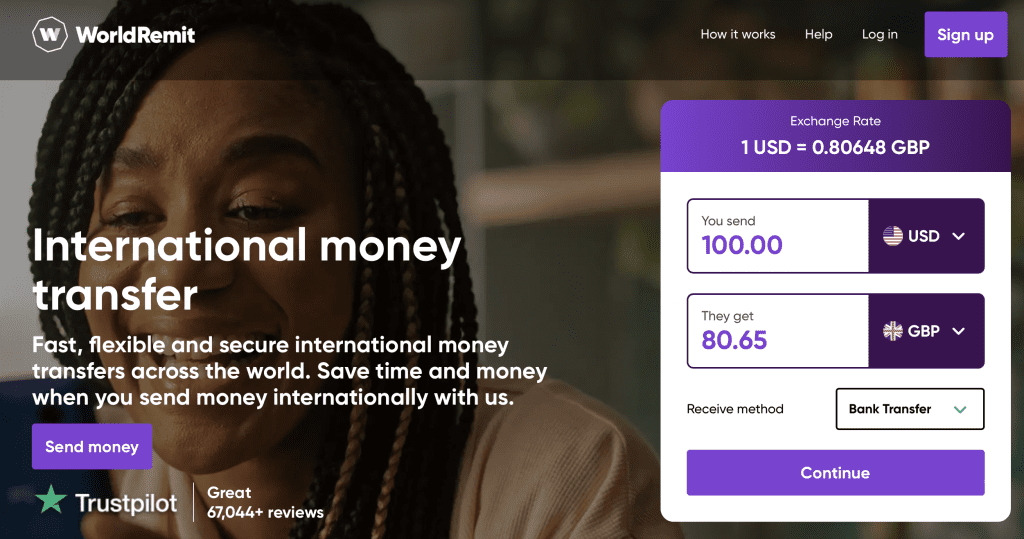

WorldRemit

WorldRemit is a leading digital money transfer company that allows customers to send and receive money all over the world. The company was founded in 2010 and is headquartered in London, United Kingdom. It provides a quick, secure, and low-cost way to send money to over 130 countries worldwide.

WorldRemit has over 4 million customers and has processed over 1 million transactions per month, totaling more than $10 billion annually. Bank transfers, mobile money, cash pick-up, and airtime top-up are among the payment methods offered by the company.

WorldRemit works with over 150 banks and financial institutions around the world to ensure that its customers receive their money quickly and securely. Customers can send and receive money from anywhere, at any time, thanks to the company’s user-friendly mobile app and website.

WorldRemit, as a socially responsible company, is dedicated to making a positive difference in the communities in which it operates. The company has collaborated with a number of charities and organizations to help refugees, education, and healthcare initiatives in developing countries.

TCV, Accel, and Leapfrog Investments led a $175 million funding round for WorldRemit in 2019, demonstrating the company’s growth and success in the digital money transfer industry. WorldRemit continues to innovate and expand its services, making sending and receiving money easier and more affordable for people all over the world.

Pros:

- Fast and convenient: WorldRemit enables quick and easy money transfers, with some transactions completed within minutes.

- Low fees: WorldRemit’s fees are typically lower than those of traditional money transfer services, making it a cost-effective option.

- Multiple. payment options: WorldRemit provides a variety of payment options, including bank transfers, mobile money, cash pick-up, and airtime top-up, giving customers greater flexibility in how they send and receive money.

- Security: WorldRemit employs advanced encryption and fraud detection technology to keep transactions safe and secure.

- Wide network: WorldRemit has partnerships with over 150 banks and financial institutions around the world, making it simple for customers to send money to a variety of countries.

Cons:

- Limited coverage: While WorldRemit has a large network, it is not be available in all countries or regions.

- Transfer limits: WorldRemit may have transfer limits, which could be a disadvantage for those who need to send large sums of money.

- Customer service: Some customers have complained about WorldRemit’s customer service, especially when it comes to resolving issues with failed transactions or delays.

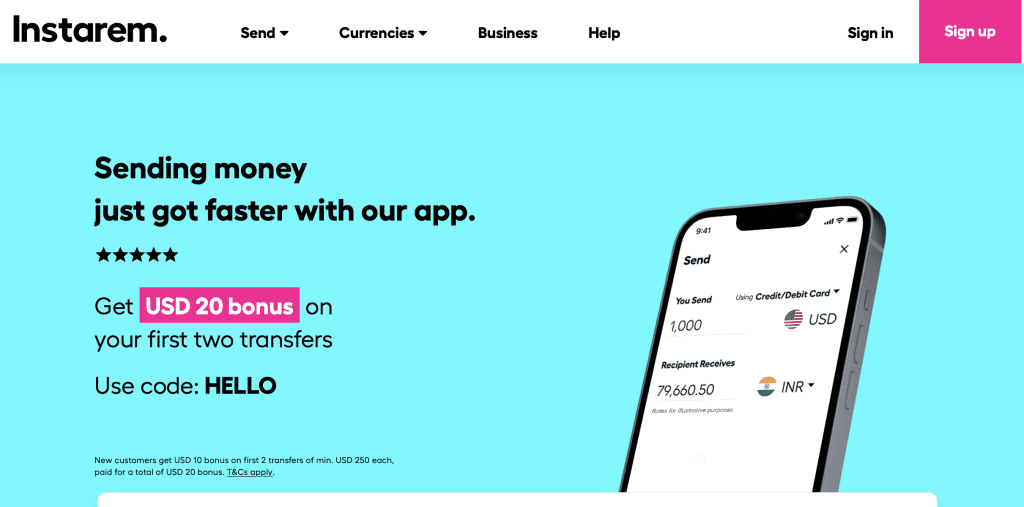

Instarem

Instarem is a leading digital cross-border payments company that provides individuals and businesses all over the world with fast and secure money transfers. The company was founded in 2014 and has expanded its operations to several countries, including the United States, Australia, Canada, and Europe.

Instarem offers a platform that allows users to send money around the world with low fees and competitive exchange rates. Bank transfers, instant transfers, and mobile wallet transfers are among the payment methods available from the company. Users of Instarem can send money to over 100 countries in over 60 currencies.

Instarem has processed over $6 billion in transactions and served over 3.5 million customers worldwide since its inception. Customers can send and receive money from anywhere, at any time, thanks to the company’s user-friendly platform and mobile app.

For its innovative payment solutions, Instarem has received several awards and recognitions, including the 2020 Singapore Fintech Award for Best Payments and Remittance Solution. The firm is also licensed and regulated by regulatory bodies such as Singapore’s Monetary Authority and the UK’s Financial Conduct Authority, ensuring that its operations are safe and compliant.

Instarem is committed to giving back to the community as a socially responsible company through its Instarem Cares program. The program prioritizes education, environmental sustainability, and disaster relief.

Instarem raised $41 million in a Series C funding round led by Vertex Growth Fund in 2019, cementing its position as a market leader in digital cross-border payments. Instarem’s services and partnerships continue to grow, making it easier and more affordable for customers to send and receive money globally.

Pros:

- Competitive exchange rates: Instarem provides competitive exchange rates.

- Low fees: Instarem’s fees are typically lower than those of traditional money transfer services, making it a cost-effective option.

- Fast and simple: Instarem enables quick and simple money transfers, with some transactions completed in minutes.

- Multiple payment options: Instarem provides customers with a variety of payment options, including bank transfers, instant transfers, and mobile wallet transfers, giving them greater flexibility in how they send and receive money.

- Security: To ensure that transactions are secure and protected, Instarem employs advanced encryption and fraud detection technology.

Cons:

- Limited coverage: While Instarem supports a wide range of countries and currencies, it may not be available in all countries or regions.

- Transfer limits: Instarem may have transfer limits, which could be a disadvantage for those sending larger amounts

- Customer service: Some customers have complained about Instarem’s customer service, particularly when it comes to resolving problems with failed transactions or delays.

PayPal

PayPal is a leading digital payments platform that enables individuals and businesses to securely and conveniently send and receive money around the world. The company, which was founded in 1998, has its headquarters in San Jose, California, and operates in over 200 markets worldwide.

PayPal provides a variety of payment options, including online, mobile, and in-person payments. The company’s platform allows users to easily pay, get paid, and manage their money online or on mobile devices. PayPal accepts over 100 currencies and enables quick and simple cross-border transactions.

PayPal has over 429 million active registered accounts as of 2022, with users in over 200 markets worldwide. Every day, the company processes more than $1 billion in payments and has facilitated over 4 billion transactions.

PayPal has received numerous awards and accolades for its innovative payment solutions, including the Best Digital Wallet Solution 2020 Mobile Payments and Banking Award. The company is also dedicated to giving back to the community through its various corporate social responsibility initiatives, such as the PayPal Gives program, which supports charitable organizations all over the world.

PayPal has expanded its business offerings beyond its core payment services, including PayPal Credit, which provides customers with financing options, and PayPal Here, a mobile card reader for small businesses. In 2013, the company also acquired Venmo, a popular peer-to-peer payment app.

PayPal is a Nasdaq-listed company with a market capitalization of more than $300 billion, making it one of the world’s largest and most successful payment platforms.

Pros:

- Ease of use: PayPal is user-friendly and simple to set up. Users can quickly create an account and begin using it.

- Wide acceptance: PayPal is widely accepted by online merchants, making it an easy payment method for online shopping.

- Security: PayPal protects users’ financial information with encryption and provides fraud protection and dispute resolution services.

- Convenience: To make or receive payments, users can link their PayPal account to a credit or debit card, bank account, or PayPal credit account.

Cons:

- Fees: Some PayPal transactions, such as international payments and currency conversions, incur fees. These fees may be higher than those charged by other payment methods.

- Account freezes: If PayPal suspects fraudulent activity, it has been known to freeze users’ accounts, which can be inconvenient for users who need access to their funds.

- Customer service is limited: PayPal’s customer service is not always easy to reach and responds to user inquiries slowly.

Frequently Asked Questions

What Exactly Is an International Money Transfer?

An international money transfer is a process of transferring money from one country to another. It is a financial transaction that involves the movement of money from one bank account to another bank account located in a different country. The process of an international money transfer can be initiated by individuals, businesses, or financial institutions.

International money transfers can be initiated through various methods such as wire transfers, online transfers, and international money orders. Wire transfers are one of the most popular methods of transferring money internationally. In this method, the sender provides their bank with the recipient’s bank account details, including the bank name, account number, and routing number. The sender’s bank then sends the money to the recipient’s bank account using a secure network.

Online transfers are another popular method of transferring money internationally. This method involves using an online payment platform or a mobile app to send money to a recipient located in a different country. The sender provides their payment details, including their bank account or credit card information, and the recipient’s bank account details to the online payment platform. The platform then facilitates the transfer of money between the sender and the recipient.

International money orders are another method of transferring money internationally. In this method, the sender purchases an international money order from their bank or post office and sends it to the recipient in a different country. The recipient can then cash the money order at their bank or post office.

International money transfers involve various fees and exchange rates that can vary depending on the method of transfer and the financial institutions involved. It is important to compare the fees and exchange rates of different financial institutions before initiating an international money transfer to ensure that you get the best deal.

In conclusion, an international money transfer is a process of transferring money from one country to another. It can be initiated through various methods such as wire transfers, online transfers, and international money orders. The process involves fees and exchange rates that can vary depending on the method of transfer and the financial institutions involved. It is important to compare the fees and exchange rates of different financial institutions before initiating an international money transfer to ensure that you get the best deal.

What Are the Different Types of Money Transfer Companies

here are several types of international money transfer companies, including traditional banks, online banks, money transfer operators, and digital payment platforms. Each type of company works differently to facilitate international money transfers.

Traditional Banks: Traditional banks are the most common way to transfer money internationally. They offer a wide range of services, including wire transfers, foreign currency accounts, and international money orders. To initiate an international money transfer through a traditional bank, the sender needs to provide the recipient’s bank details, including the bank name, account number, and routing number. The transfer fees for traditional banks are generally higher than other types of money transfer companies, and the exchange rate may not be the best available.

Online Banks: Online banks operate entirely online and offer similar services to traditional banks, including international money transfers. They tend to have lower transfer fees and better exchange rates than traditional banks. To initiate an international money transfer through an online bank, the sender needs to provide the recipient’s bank details, similar to traditional banks.

Money Transfer Operators: Money transfer operators specialize in transferring money internationally. They operate through physical locations, such as agent locations and kiosks. The sender needs to provide identification and the recipient’s information to initiate a money transfer through a money transfer operator. The transfer fees for money transfer operators can vary significantly, and the exchange rate may not be the best available.

Digital Payment Platforms: Digital payment platforms allow individuals to transfer money internationally through a mobile app or website. They offer competitive exchange rates and lower transfer fees than traditional banks and money transfer operators. To initiate an international money transfer through a digital payment platform, the sender needs to provide the recipient’s bank details or mobile phone number.

Regardless of the type of international money transfer company used, it is essential to compare the fees and exchange rates to ensure that you get the best deal. It is also important to ensure that the company is secure and has adequate measures in place to protect your personal and financial information.

What is the Difference Between an International Money Transfer a Bank Wire Transfer

An international money transfer and a bank wire transfer are similar in that they both involve the movement of money from one bank account to another. However, there are some differences between the two.

Scope: An international money transfer can be initiated through a variety of methods, including wire transfers, online transfers, and money orders. In contrast, a bank wire transfer specifically refers to the process of transferring funds through a traditional bank. Bank wire transfers are typically used for larger transfers, such as business transactions or property purchases.

Fees: Fees for international money transfers can vary depending on the method used and the financial institution involved. Bank wire transfers tend to have higher fees compared to other methods of international money transfers.

Exchange Rates: When transferring money internationally, exchange rates are an important consideration. Bank wire transfers may not offer the best exchange rate available, and may include additional fees or commissions.

Speed: International money transfers can take varying amounts of time to complete, depending on the method and the destination. Bank wire transfers typically take one to two business days to complete, while other methods such as online transfers and digital payment platforms can be completed within minutes or hours.

In summary, while bank wire transfers are a specific method of transferring money internationally through a traditional bank, an international money transfer encompasses a broader range of methods, including wire transfers. The fees, exchange rates, and speed of international money transfers can vary depending on the method used and the financial institution involved. It is important to compare the different options and choose the best one for your specific needs.

How Safe Are International Money Transfer Organizations?

International money transfer organizations are generally considered safe for transferring money across borders. These companies are regulated by various financial regulatory authorities in different countries to ensure that they comply with the relevant laws and regulations.

However, it is important to note that no system is completely foolproof, and there is always a risk of fraud or hacking. Therefore, it is important to take precautions when using these services, such as:

Use a secure internet connection and trusted device when making transfers.

Only use reputable transfer companies that are licensed and regulated.

Check the exchange rate and transfer fees before making a transfer.

Be cautious of any unsolicited emails or phone calls requesting money transfers.

Always double-check the recipient’s details before making a transfer.

By following these precautions, you can minimize the risks associated with international money transfers and ensure that your money is safe.

What Accreditations and Affiliations Should I Look For In a Money Transfer Company?

When looking for a reliable money transfer company, you should look for accreditations and licenses from reputable financial regulatory authorities. The specific accreditations may vary depending on the country and region you are in, but some of the most common ones include:

Financial Conduct Authority (FCA): This is a UK-based regulatory authority that oversees financial services companies to ensure they operate fairly and transparently.

Consumer Financial Protection Bureau (CFPB): This is a US-based regulatory authority that enforces laws and regulations to protect consumers in financial transactions.

Australian Securities and Investments Commission (ASIC): This is an Australian regulatory authority that regulates financial services companies to ensure they operate fairly and transparently.

European Banking Authority (EBA): This is a European Union regulatory authority that oversees financial services companies to ensure they comply with EU banking regulations.

Monetary Authority of Singapore (MAS): This is a Singaporean regulatory authority that regulates financial services companies to ensure they operate fairly and transparently.

It’s important to note that some money transfer companies may hold multiple accreditations from different regulatory authorities. By choosing a company that holds accreditations from reputable regulatory authorities, you can ensure that the company is operating transparently and is subject to regulatory oversight.

What Is the Difference Between a Money Transfer Service and Currency Broker?

A money transfer service and a currency broker are both companies that specialize in facilitating foreign currency transactions, but there are some key differences between the two.

A money transfer service, such as Wise, specializes in transferring money from one account to another, typically between individuals or businesses located in different countries. These services often provide a quick and convenient way to transfer money, and they typically charge a fee for their services. The exchange rate used by these services may not be the most favorable available, but they usually offer a fixed exchange rate for a certain period of time to provide certainty to their customers.

On the other hand, a currency broker, such as Currencies Direct or XE, specializes in providing foreign exchange services to clients who need to exchange large amounts of currency, typically for business or investment purposes. These brokers often offer more competitive exchange rates than money transfer services, and they typically charge lower fees as well. Currency brokers typically require clients to open an account with them and provide more information about their financial situation and the nature of their currency transactions.

In summary, money transfer services are focused on providing a quick and convenient way to transfer money between individuals or businesses, while currency brokers are focused on providing foreign exchange services to clients who need to exchange larger amounts of currency and are looking for more favourable exchange rates.

How Much Do International Money Transfer Services Cost?

The cost of using international money transfer services can vary depending on the provider and the specifics of the transaction. Some of the factors that can impact the cost of an international money transfer include:

Transfer amount: Generally, the higher the amount of money being transferred, the higher the fees will be.

Exchange rate: Some providers offer less favorable exchange rates than others, which can impact the overall cost of the transfer.

Transfer speed: If you need to transfer money quickly, you may need to pay an additional fee for expedited service.

Payment method: Some payment methods, such as credit cards, may come with additional fees.

Destination country: Some providers may charge more for transfers to certain countries due to higher processing costs or other factors.

In terms of specific costs, international money transfer services typically charge a combination of fees and/or a percentage-based markup on the exchange rate. Fees can range from a few dollars to $50 or more, depending on the provider and the specifics of the transaction. Exchange rate markups can range from 1% to 5% or more.

It’s important to compare the costs and exchange rates offered by different providers to ensure that you are getting the best deal.

Additionally, be sure to factor in any potential fees or charges associated with receiving the money on the other end, such as bank fees or currency conversion fees.

What Services Do International Remittance Companies Provide?

nternational remittance companies provide a range of services related to sending money across borders. Some of the most common services provided by these companies include:

Money transfers: This is the core service provided by international remittance companies. These companies allow individuals and businesses to send money to recipients located in other countries.

Currency exchange: Some international remittance companies also offer currency exchange services, which allow individuals and businesses to exchange one currency for another. This service is often used in conjunction with money transfers.

Bill payments: Some international remittance companies allow customers to pay bills in other countries, such as utilities, rent, or mortgage payments.

Mobile payments: Many international remittance companies offer mobile payment options, which allow customers to send and receive money using their mobile devices.

Prepaid cards: Some international remittance companies offer prepaid debit cards, which can be used to make purchases or withdraw cash from ATMs in other countries.

Business services: Some international remittance companies offer specialized services for businesses, such as payroll processing, invoicing, or supplier payments.

Overall, international remittance companies provide a range of services designed to make it easier and more affordable to send money across borders. These services can be especially valuable for individuals and businesses that need to send money to friends, family members, or business partners located in other countries.

How To Choose the Best Money Transfer Provider?

Choosing the best international money transfer company can depend on your specific needs and preferences, but here are some factors to consider when making your decision:

Fees and exchange rates: Look for a company that offers competitive fees and exchange rates. Some companies may offer lower fees but have less favorable exchange rates, while others may charge higher fees but offer better exchange rates.

Transfer speed: Consider how quickly you need the money to arrive at its destination. Some companies offer expedited service for an additional fee, while others may take several days or longer to complete the transfer.

Transfer limits: Make sure the company can accommodate the amount of money you want to transfer. Some companies have lower transfer limits than others, and may require additional verification for larger transfers.

Security and reliability: Choose a company that is licensed and regulated by reputable financial authorities to ensure that your money is safe and secure during the transfer process.

Customer service: Look for a company that offers responsive and helpful customer service, including a variety of contact options such as phone, email, and chat.

User experience: Consider the user experience of the company’s website or mobile app. Is it easy to use and navigate? Are there any additional features, such as tracking or notifications, that could be helpful?

Reviews and ratings: Check out reviews and ratings of the company from other customers to get an idea of their experiences and any potential issues or concerns.’

Overall, take the time to compare multiple international money transfer provider to find the one that best meets your specific needs and preferences.

What Type of Fees Do International Money Transfer Companies Charge?

International money transfer companies charge a variety of fees that can vary depending on the company and the specifics of the transaction. Here are some of the most common fees you may encounter:

Transfer fees: These are fees charged by the company for processing the transfer. Transfer fees can be a flat fee or a percentage of the transfer amount and can range from a few dollars to $50 or more.

Exchange rate markups: International money transfer companies often charge a markup on the exchange rate they offer, which can impact the overall cost of the transfer. The markup can range from 1% to 5% or more.

Receiving fees: Some companies may charge a fee to the recipient for receiving the money, which can vary depending on the country and the method of receipt.

Cancellation or amendment fees: If you need to cancel or amend a transfer, you may be charged a fee by the company.

Expedited transfer fees: If you need the money to arrive quickly, you may be charged an additional fee for expedited service.

Payment method fees: Some payment methods, such as credit cards or certain bank transfers, may come with additional fees.

It’s important to carefully review the fee structure of any international money transfer company before initiating a transfer to understand the total cost of the transaction. Additionally, be sure to factor in any potential fees or charges associated with receiving the money on the other end, such as bank fees or currency conversion fees.

How to Use an International Money Transfer Service to Send Money Abroad?

The process of using an international money transfer service to send money abroad may vary depending on the company, but here is a general outline of the steps involved:

Set up an account: If you don’t already have an account with the international money transfer company, you will need to set one up. This may involve providing personal information, such as your name, address, and identification.

Enter transfer details: Once you have an account, you will need to enter the details of the transfer, such as the amount you want to send, the currency you want to send it in, and the recipient’s information, including their name, address, and bank details.

Choose payment method: You will need to choose a payment method to fund the transfer, such as a bank transfer, credit card, or debit card. Some methods may come with additional fees or processing times.

Review fees and exchange rate: Before finalizing the transfer, you will have an opportunity to review the fees and exchange rate being offered by the company.

Confirm and authorize transfer: Once you are satisfied with the details of the transfer, you will need to confirm and authorize it. Depending on the company, you may receive a confirmation email or notification once the transfer has been processed.

Track transfer: Some international money transfer companies offer the ability to track the progress of the transfer, which can help you and the recipient stay informed about when the money will arrive.

Notify recipient: Once the transfer has been completed, you may need to notify the recipient that the money is on the way and provide any necessary details, such as a reference number or confirmation code.

What Is it Better To Use a Money Transfer Company Instead of a Bank?

There are several reasons why it may be better to use an international money transfer company instead of a bank to transfer money abroad:

Lower fees: International money transfer companies often offer lower fees than banks, especially for smaller transfers. This can help you save money on the overall cost of the transfer.

Better exchange rates: International money transfer companies may offer more competitive exchange rates than banks, which can also help you save money. Banks may charge higher exchange rate markups or fees, which can add up over time.

Faster processing times: International money transfer companies may be able to process transfers more quickly than banks, which can be important if you need the money to arrive quickly. Some companies offer expedited service for an additional fee.

More options: International money transfer companies may offer a wider range of payment and delivery options than banks, including cash pickup, mobile wallet transfers, and more.

Dedicated customer service: International money transfer companies often offer more dedicated and responsive customer service than banks, which can be important if you need help or have questions about the transfer.

How Long Does it Take to Transfer Money Internationally?

The length of time it takes to transfer money internationally can vary depending on several factors, including:

Payment method: The payment method you use to fund the transfer can impact the processing time. For example, a bank transfer may take longer than a credit card or debit card payment.

Transfer method: The transfer method you choose can also impact the processing time. For example, a cash pickup may be available immediately, while a bank deposit may take a few business days to clear.

Country and currency: The countries and currencies involved in the transfer can impact the processing time. Some countries or currencies may have longer processing times or require additional verification steps.

Company processing time: The processing time of the international money transfer company you are using can also impact the overall transfer time. Some companies may offer expedited service for an additional fee.