OFX is a prominent international money transfer service that aims to provide users with a reliable and cost-effective way to send money across borders. In today’s interconnected world, transferring money globally has become a common necessity for individuals and businesses alike. With an abundance of choices in the market, selecting the right service can be challenging. This review will assess OFX based on various factors, including user experience, transfer process, fees, exchange rates, security, and comparisons with competitors.

OFX Key Facts

| Fact | Details |

|---|---|

| Company Name | OFX (formerly OzForex) |

| Founded | 1998 |

| Headquarters | Sydney, Australia |

| CEO | Mark Ledsham |

| Number of Employees | 300+ (as of 2023) |

| Services Offered | International money transfers for individuals and businesses |

| Geographical Coverage | Over 190 countries |

| Supported Currencies | More than 55 currencies |

| Transfer Options | Single transfers, recurring transfers, forward contracts |

| Transfer Speed | Typically 1-5 business days |

| Transfer Limits | Minimum: $1,000 (or equivalent) / Maximum: No limit |

| Fees | Flat fee for transfers below a certain threshold, fee-free for transfers above the threshold |

| Fee Example (US) | $5 fee for transfers under $5,000, fee-free above $5,000 |

| Fee Example (UK) | £7 fee for transfers under £3,000, fee-free above £3,000 |

| Exchange Rate Margins | Margin added to the mid-market exchange rate |

| Security and Compliance | Licensed and regulated, advanced security measures |

| Regulatory Bodies | FinCEN (US), FCA (UK), ASIC (Australia), and others |

| Customer Support | 24/7 phone support, email support, FAQ section |

| User Interface | Web-based platform, no dedicated mobile app |

| Payment Methods | Bank transfer, debit card (in some countries) |

| Payout Methods | Bank account deposit |

| Competitors | Wise (formerly TransferWise), Revolut, WorldRemit |

| Notable Partnerships | ING Direct, Macquarie, Travelex |

| Market Position | Among the top online money transfer services |

Company Background

History of OFX

OFX, previously known as OzForex, was founded in 1998 in Sydney, Australia. Initially, the company focused on providing foreign exchange information and quickly evolved into an online service offering international money transfers at competitive exchange rates. Over the years, OFX has expanded its services and now operates in multiple countries, including the United States, the United Kingdom, Canada, and New Zealand. As of 2023, the company has handled more than $150 billion in transactions and has become a trusted provider in the money transfer industry.

OFX Services Offered

OFX provides a range of money transfer services catering to individual and business needs. For individuals, the platform allows personal transfers for purposes such as paying mortgages, funding overseas education, and sending money to friends and family. Businesses can benefit from OFX’s tailored solutions, including risk management tools, mass payments, and local currency accounts for international transactions.

- Personal Money Transfers: OFX helps individuals send money overseas for various purposes such as making mortgage payments, funding overseas education, purchasing property abroad, or repatriating income. The competitive exchange rates and low fees make it an attractive choice for personal money transfers.

- Business Money Transfers: OFX assists businesses in transferring funds for international trade, paying invoices, managing global payroll, and repatriating profits. The platform’s competitive rates and tailored solutions help businesses save on currency conversion costs and streamline their international payment processes.

- Single Transfers: Users can make one-time transfers for immediate or future-dated transactions. This option is suitable for those who need to send money occasionally or for a specific purpose.

- Recurring Transfers: OFX allows users to set up automated, regular transfers for ongoing expenses, such as mortgage payments, rent, or tuition fees. Users can schedule these transfers weekly, monthly, or quarterly, ensuring timely payments without the need for manual intervention.

- Forward Contracts: OFX offers forward contracts, allowing users to lock in an exchange rate for future transfers, up to two years in advance. This service helps protect against currency fluctuations and provides certainty in the cost of future transactions, which can be especially beneficial for businesses with long-term commitments or individuals planning large purchases.

- Limit Orders: Users can set a target exchange rate for their transfer, and OFX will automatically execute the transaction once the desired rate is reached. This service enables users to take advantage of favorable market conditions without constantly monitoring exchange rates.

- Risk Management: OFX provides risk management solutions to help businesses navigate the complexities of the foreign exchange market. By offering tailored strategies, such as forward contracts and limit orders, OFX assists businesses in minimizing the risks associated with currency fluctuations.

What Currencies Does OFX Support?

OFX supports an extensive range of currencies, making it an ideal choice for users looking to send money to various destinations worldwide. The platform allows users to transfer money in more than 55 currencies, including major, minor, and exotic currencies. Here is a list of some of the most commonly traded currencies supported by OFX:

- United States Dollar (USD)

- Euro (EUR)

- British Pound Sterling (GBP)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

- Swiss Franc (CHF)

- Japanese Yen (JPY)

- Chinese Yuan Renminbi (CNY)

- Indian Rupee (INR)

- South African Rand (ZAR)

- Hong Kong Dollar (HKD)

- Singapore Dollar (SGD)

- Swedish Krona (SEK)

- Norwegian Krone (NOK)

- Danish Krone (DKK)

- Mexican Peso (MXN)

- Brazilian Real (BRL)

- United Arab Emirates Dirham (AED)

- Israeli Shekel (ILS)

Please note that this is not an exhaustive list, and OFX may support additional currencies. It is essential to check the OFX website or contact their customer support to confirm if a specific currency is supported for your desired transfer destination.

OFX’s extensive currency coverage allows users to send money to over 190 countries, making it a convenient and comprehensive choice for international money transfers. The platform’s competitive exchange rates and low fees further enhance its appeal for users seeking a cost-effective and reliable solution for their currency transfer need

Currency Converter and Market Insights: The OFX platform includes a currency converter tool, allowing users to calculate the cost of their transfers based on current exchange rates. Additionally, OFX provides market insights and analysis to help users make informed decisions about their transfers and stay updated on the latest currency trends.

OFX Geographical Coverage

With a global presence, OFX supports transfers to over 190 countries and deals in more than 55 currencies. The company has a network of bank accounts worldwide, which enables it to offer faster and more cost-effective transfers compared to traditional banks. OFX’s extensive reach makes it an attractive option for those with diverse international transfer needs.

OFX User Experience

Account Setup Process

Setting up an account with OFX is straightforward and can be completed online within a few minutes. New users need to provide personal information, including name, address, date of birth, and contact details. OFX also requires identity verification, which can typically be done by uploading a valid ID, such as a passport or driver’s license. Once the account is verified, users can start making transfers.

Ease Of Use

OFX’s platform is designed to be user-friendly, with a simple interface and clear instructions. Users can initiate transfers by selecting the currencies, entering the amount, and providing the recipient’s bank account details. The platform also offers helpful tools, such as exchange rate alerts and currency converter calculators, to assist users in making informed decisions.

Customer Support

Customer support is an essential aspect of any financial service, and OFX does not disappoint in this regard. They offer 24/7 phone support, email support, and an extensive FAQ section on their website. The company’s customer service representatives are knowledgeable and responsive, ensuring users receive timely assistance with any issues or inquiries they may have.

OFX Transfer Process

Transfer Options

OFX offers several transfer options, including single transfers, recurring transfers, and forward contracts. Single transfers are ideal for one-time transactions, while recurring transfers can be set up for regular payments, such as monthly expenses or mortgage payments. Forward contracts enable users to lock in exchange rates for future transfers, providing protection against currency fluctuations. This range of options allows users to choose the best method for their specific needs.

Transfer Speed

The transfer speed with OFX varies depending on factors such as the destination country, currency, and the banks involved in the transaction. Generally, transfers can take between 1-5 business days. OFX’s extensive network of global bank accounts helps expedite the process, making it faster than many traditional banks. However, some competitors may offer even quicker transfer speeds, depending on the circumstances.

Transfer Limits

OFX has a minimum transfer limit of $1,000 (or equivalent in other currencies), which may not be suitable for users seeking to send smaller amounts. However, there is no maximum transfer limit, allowing users to transfer large sums without restrictions. This flexibility makes OFX an appealing choice for high-value transactions.

OFX Fees and Exchange Rates

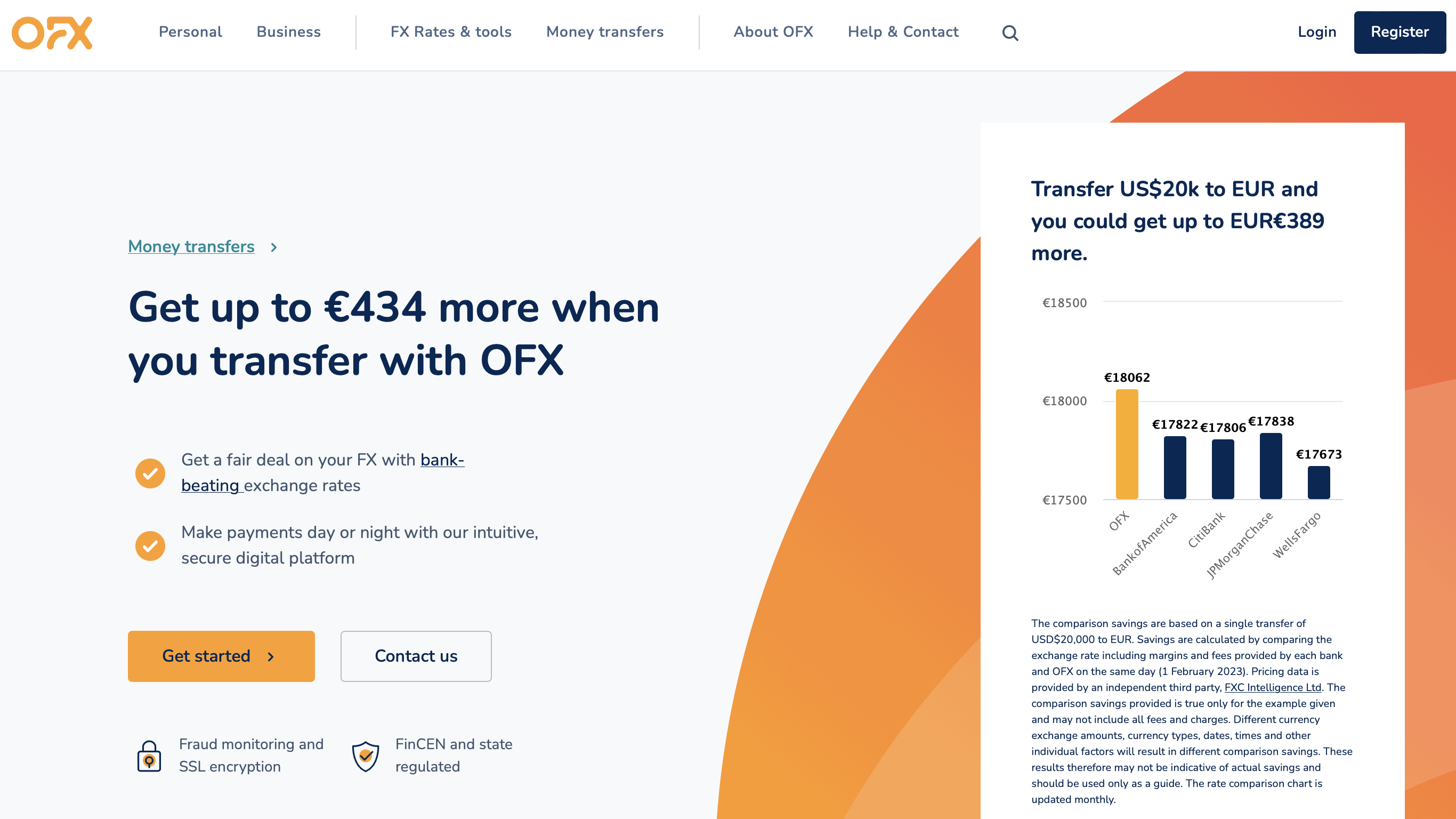

Comparison With Competitors

When it comes to fees and exchange rates, OFX is often more competitive than traditional banks, which tend to charge higher fees and offer less favorable exchange rates. However, some online competitors may offer lower fees or better exchange rates depending on the transfer amount and currency pair. It is essential for users to compare fees and rates across various services to determine the best option for their specific needs.

Fee structure

OFX charges a flat fee for transfers below a certain threshold, which varies depending on the sender’s country. For example, in the United States, a $5 fee is applied to transfers under $5,000, while in the United Kingdom, a £7 fee is charged for transfers below £3,000. Transfers above these thresholds are fee-free. Although OFX’s fee structure is generally reasonable, some competitors, like Currencies Direct, offer completely fee-free transfers, regardless of the amount.

Exchange Rate Margins

OFX adds a margin to the mid-market exchange rate, which is the rate at which banks and financial institutions trade currencies. While this margin is typically lower than those applied by traditional banks, some online competitors may offer even tighter margins. Users should compare exchange rates across multiple services to ensure they are getting the best deal possible.

OFX Security and Regulation

Compliance With Regulations

OFX is a licensed and regulated financial institution, adhering to strict regulatory requirements in each country it operates. In the United States, OFX is registered with the Financial Crimes Enforcement Network (FinCEN) and is licensed as a money transmitter in various states. In the United Kingdom, the company is authorized by the Financial Conduct Authority (FCA) as an Electronic Money Institution. These regulatory approvals ensure that OFX operates within legal guidelines and maintains high standards of security and compliance.

User Data Protection

Protecting users’ personal and financial information is a top priority for OFX. The company employs advanced encryption technologies to safeguard data and follows industry best practices for secure data storage. Additionally, OFX has implemented robust security measures, such as two-factor authentication and periodic security audits, to further protect users’ information.

Fraud Prevention Measures

OFX takes fraud prevention seriously, employing dedicated fraud detection teams and advanced monitoring systems to identify and prevent suspicious activity. The company also provides users with resources and guidelines for recognizing and avoiding potential scams, ensuring a secure money transfer experience.

Is OFX Safe To Use?

Yes, OFX is safe to use for international money transfers. The company employs multiple layers of security and regulatory compliance measures to ensure the safety and protection of user funds and personal information. Some key aspects contributing to OFX’s safety include:

- Regulatory Compliance: OFX is licensed and regulated by numerous financial authorities worldwide, including the Financial Crimes Enforcement Network (FinCEN) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC) in Australia, and other relevant regulatory bodies in different countries. These regulatory frameworks require OFX to adhere to strict guidelines and maintain high operational standards, ensuring the safety of customer funds and data.

- Secure Data Encryption: OFX uses advanced data encryption technology to protect sensitive user information and transactions. The platform employs 256-bit SSL encryption, which is the same level of security used by major banks, to safeguard data transmission between users and the OFX servers.

- Segregated Client Accounts: OFX holds customer funds in segregated client accounts separate from the company’s own operating funds. This practice ensures that client money is protected even in the unlikely event of the company facing financial difficulties.

- Two-Factor Authentication (2FA): OFX offers two-factor authentication, adding an extra layer of security to user accounts. With 2FA enabled, users are required to provide an additional form of verification, such as a unique code sent via text message or generated through an authentication app, to access their accounts or initiate transfers.

- Fraud Prevention Measures: OFX has a dedicated fraud prevention team that monitors transactions for suspicious activity and implements measures to minimize the risk of fraud. The company also provides resources and guidance to educate users about online security and fraud prevention.

- Long-standing Reputation: OFX has been in operation since 1998 and has successfully processed billions of dollars in transfers. The company has built a strong reputation for reliability and trustworthiness, with numerous positive reviews and testimonials from satisfied customers.

OFX Pros and Cons

Benefits of Using OFX

- Competitive fees and exchange rates: OFX generally offers lower fees and better exchange rates compared to traditional banks, making it a cost-effective choice for international money transfers.

- Extensive global reach: With support for over 190 countries and 55 currencies, OFX caters to a wide range of international transfer needs.

- Multiple transfer options: Users can choose from single transfers, recurring transfers, and forward contracts, allowing them to select the most suitable option for their specific requirements.

- No maximum transfer limit: OFX allows users to transfer large sums without restrictions, making it an ideal choice for high-value transactions.

- Strong security and compliance: OFX is a regulated financial institution that employs advanced security measures to protect user information and ensure compliance with legal guidelines.

Drawbacks of Using OFX

- Minimum transfer limit: With a minimum transfer limit of $1,000 (or equivalent), OFX may not be suitable for users seeking to send smaller amounts.

- Transfer speed: While OFX’s transfer speeds are generally faster than traditional banks, some competitors may offer quicker transfers depending on the destination country and currency pair.

- No mobile app: Unlike some competitors, OFX does not offer a dedicated mobile app, which may be inconvenient for users who prefer managing transfers on the go.

OFX Alternatives

OFX vs. Currencies Direct

Here is a detailed comparison table highlighting the key features of OFX and Currencies Direct:

| Feature | OFX | Currencies Direct |

|---|---|---|

| Founded | 1998 | 1996 |

| Number of Currencies | Over 55 | Over 40 |

| Transfer Fees | No fees for most transfers; some exceptions apply | No fees |

| Minimum Transfer Amount | $1,000 (USD) or equivalent in other currencies | £100 (GBP) or equivalent in other currencies |

| Transfer Types | Single transfers, recurring transfers, forward contracts, limit orders | Single transfers, regular transfers, forward contracts, limit orders |

| Speed | 1-5 business days | 1-3 business days (typical) |

| Customer Support | Phone, email, and extensive FAQ section | Phone, email, and online chat |

| Online Platform | Yes | Yes |

| Mobile App | Yes (iOS and Android) | Yes (iOS and Android) |

| Regulatory Compliance | Licensed and regulated by FinCEN (US), FCA (UK), ASIC (Australia), and other financial authorities | Licensed and regulated by FCA (UK), FinCEN (US), and other financial authorities |

| Trustpilot Rating | 4.2/5 (Excellent) | 4.9/5 (Excellent) |

OFX vs. XE Money Transfer

| Feature | OFX | XE |

|---|---|---|

| Founded | 1998 | 1993 |

| Number of Currencies | Over 55 | Over 100 |

| Transfer Fees | No fees for most transfers; some exceptions apply | No fees |

| Minimum Transfer Amount | $1,000 (USD) or equivalent in other currencies | No minimum |

| Transfer Types | Single transfers, recurring transfers, forward contracts, limit orders | Single transfers, recurring transfers, forward contracts, limit orders |

| Speed | 1-5 business days | 1-4 business days (typical) |

| Customer Support | Phone, email, and extensive FAQ section | Phone, email, and extensive FAQ section |

| Online Platform | Yes | Yes |

| Mobile App | Yes (iOS and Android) | Yes (iOS and Android) |

| Regulatory Compliance | Licensed and regulated by FinCEN (US), FCA (UK), ASIC (Australia), and other financial authorities | Licensed and regulated by FCA (UK), FinCEN (US), ASIC (Australia), and other financial authorities |

| Trustpilot Rating | 4.2/5 (Excellent) | 4.2/5 (Great) |

OFX vs. Wise (formerly TransferWise)

| Feature | OFX | Wise |

|---|---|---|

| Founded | 1998 | 2010 |

| Number of Currencies | Over 55 | Over 50 supported, 750+ routes for currency conversion |

| Transfer Fees | No fees for most transfers; some exceptions apply | Percentage-based fees, depending on the currencies and amount |

| Minimum Transfer Amount | $1,000 (USD) or equivalent in other currencies | No minimum |

| Transfer Types | Single transfers, recurring transfers, forward contracts, limit orders | Single transfers, recurring transfers, business accounts, multi-currency accounts, debit card |

| Speed | 1-5 business days | 1-3 business days (typical) |

| Customer Support | Phone, email, and extensive FAQ section | Email, live chat, phone (for select countries), and extensive FAQ section |

| Online Platform | Yes | Yes |

| Mobile App | Yes (iOS and Android) | Yes (iOS and Android) |

| Regulatory Compliance | Licensed and regulated by FinCEN (US), FCA (UK), ASIC (Australia), and other financial authorities | Licensed and regulated by FCA (UK), FinCEN (US), ASIC (Australia), and other financial authorities |

| Trustpilot Rating | 4.2/5 (Excellent) | 4.4/5 (Excellent) |

OFX vs. WorldRemit

| Feature | OFX | WorldRemit |

|---|---|---|

| Founded | 1998 | 2010 |

| Number of Currencies | Over 55 | Over 90 |

| Transfer Fees | No fees for most transfers; some exceptions apply | Fees vary depending on currencies, amount, and transfer method |

| Minimum Transfer Amount | $1,000 (USD) or equivalent in other currencies | No minimum |

| Transfer Types | Single transfers, recurring transfers, forward contracts, limit orders | Single transfers, mobile wallet transfers, cash pickups, airtime top-ups, bill payments |

| Speed | 1-5 business days | Within minutes to 3 business days, depending on the transfer method and destination |

| Customer Support | Phone, email, and extensive FAQ section | Phone, email, live chat, and extensive FAQ section |

| Online Platform | Yes | Yes |

| Mobile App | Yes (iOS and Android) | Yes (iOS and Android) |

| Regulatory Compliance | Licensed and regulated by FinCEN (US), FCA (UK), ASIC (Australia), and other financial authorities | Licensed and regulated by FCA (UK), FinCEN (US), and other financial authorities |

| Trustpilot Rating | 4.2/5 (Excellent) | 3.9/5 (Great) |

OFX Competitors

Wise (formerly TransferWise)

TransferWise, now known as Wise, is a popular online money transfer service that often offers lower fees and more favorable exchange rates than traditional banks. Unlike OFX, Wise uses the mid-market exchange rate and charges a percentage-based fee instead of a fixed fee. This fee structure can result in lower costs for small transfers but may be more expensive for larger amounts. Wise also provides a mobile app for added convenience but has a lower maximum transfer limit compared to OFX.

Revolut

Revolut is a digital banking platform that offers international money transfers along with various financial services. Revolut users can send money at the interbank exchange rate during market hours, making it an attractive option for cost-conscious users. However, Revolut imposes a monthly transfer limit for free transfers, and additional fees apply once the limit is exceeded. Unlike OFX, Revolut supports smaller transfers but may not be as suitable for high-value transactions due to its transfer limits.

WorldRemit

WorldRemit is another online money transfer service that supports transfers to over 150 countries. WorldRemit allows users to send money for cash pickup, mobile money, and airtime top-ups, in addition to bank transfers. While WorldRemit’s fees and exchange rates are generally competitive, they can vary widely depending on the destination country and transfer method. Like Wise, WorldRemit offers a mobile app for managing transfers but has a lower maximum transfer limit compared to OFX.

Use Cases and Recommendations

OFX is an excellent choice for high-value transactions due to its lack of maximum transfer limits and competitive fees and exchange rates. It is also well-suited for users who require recurring transfers or forward contracts to manage currency risk.

OFX is particularly beneficial for individuals and businesses with diverse international transfer needs, thanks to its extensive global reach and wide range of supported currencies.

Overall Recommendation

OFX is a reliable and cost-effective money transfer service that offers several advantages over traditional banks and some competitors. However, users seeking to send smaller amounts or prioritize transfer speed may find other options more suitable. It is crucial to compare fees, exchange rates, and features across multiple services to determine the best choice for one’s specific needs.

OFX Contact Details

OFX maintains a strong global presence with offices in multiple countries. Users can reach OFX’s customer support through various channels, including phone and email support. Here is a list of contact details for OFX’s global offices:

OFX Global Headquarters

- Location: Sydney, Australia

- Address: Level 19, 60 Margaret Street, Sydney, NSW 2000, Australia

- Phone: +61 2 8667 8090

- Email: [email protected]

OFX United States

- Location: San Francisco, California

- Address: 49 Stevenson St, 13th Floor, San Francisco, CA 94105, United States

- Phone: +1 888-288-7354 (Toll-free), +1 415-680-2785 (Local)

- Email: [email protected]

OFX United Kingdom

- Location: London, United Kingdom

- Address: 4th Floor, The White Chapel Building, 10 Whitechapel High Street, London, E1 8QS, United Kingdom

- Phone: +44 207 614 4194

- Email: [email protected]

OFX Canada

- Location: Toronto, Ontario

- Address: Suite 100, 60 Adelaide Street East, Toronto, Ontario, M5C 3E4, Canada

- Phone: +1 800-680-0750 (Toll-free), +1 416-649-8598 (Local)

- Email: [email protected]

OFX New Zealand

- Location: Auckland, New Zealand

- Address: Level 26, PWC Tower, 188 Quay Street, Auckland, 1010, New Zealand

- Phone: +64 9 281 2012

- Email: [email protected]

OFX Singapore

- Location: Singapore

- Address: 10 Collyer Quay, Level 40, Ocean Financial Centre, Singapore 049315

- Phone: +65 6653 5086

- Email: [email protected]

OFX Hong Kong

- Location: Hong Kong

- Address: Suite 202, 2/F Chinachem Hollywood Centre, 1-13 Hollywood Road, Central, Hong Kong

- Phone: +852 3008 5722

- Email: [email protected]

For general inquiries or support, customers can reach out to OFX through their email address ([email protected]) or by contacting the phone number associated with their local office. Additionally, the OFX website (https://www.ofx.com/en-us/support/) provides an extensive FAQ section, which can address many common questions and concerns.

Conclusion

OFX is a reputable international money transfer service that offers a range of features, making it a compelling choice for various transfer needs. Its competitive fees, favorable exchange rates, and extensive geographical coverage set it apart from traditional banks and some online competitors. OFX’s platform is user-friendly, and the company provides excellent customer support, ensuring a smooth and hassle-free experience. While OFX has some drawbacks, such as a minimum transfer limit and the absence of a mobile app, its advantages often outweigh these limitations for many users.

In conclusion, OFX is a reliable and cost-effective option for individuals and businesses seeking to send money internationally. Its diverse transfer options, strong security measures, and regulatory compliance make it a trustworthy choice for users worldwide. As with any financial service, it is essential to carefully consider one’s specific needs and compare various options to make the most informed decision. By assessing factors such as fees, exchange rates, transfer speeds, and customer support, users can confidently select the best money transfer service for their unique requirements.

Frequently Asked Questions

How Long Do Transfers Take With OFX?

The transfer time with OFX typically ranges from 1 to 5 business days. Several factors can influence the duration of a transfer, including:

Currency Pair: Some currencies may be exchanged more quickly than others due to their liquidity and the availability of funds in the destination country.

Destination Country: The processing time can vary depending on the destination country’s banking system and local regulations.

Transfer Method: The method used to fund the transfer, such as a bank transfer or debit card payment, can impact the time it takes for funds to reach OFX before being sent to the recipient.

Time of Submission: The time at which the transfer is initiated can affect the processing time. Transfers submitted during business hours or before the cut-off time for a specific currency are likely to be processed more quickly than those submitted outside of these hours.

Bank Holidays and Weekends: Transfers can be delayed if they coincide with bank holidays or weekends in the sending or receiving countries.

Verification Procedures: In some cases, additional verification may be required for large transfers or to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. This can add extra time to the transfer process.