Transferring money across borders has become an essential part of our personal and professional lives in today’s globalized world. As the demand for seamless, efficient, and secure money transfer services grows, a number of new players have entered the market to meet it. XE Money Transfer has emerged as a popular option for both individuals and businesses. We will delve into the world of XE Money Transfer in this review, examining its features, fees, and overall user experience to help you decide whether this service is the best option for your international money transfer needs. Join us as we deconstruct XE Money Transfer and discover what sets it apart from the competition.

XE Company Overview

XE Money Transfer is a well-known provider of international money transfers and currency exchange services. Beric Farmer and Steven Dengler founded the company in 1993, and it is headquartered in Newmarket, Ontario, Canada. XE began by providing accurate and up-to-date currency exchange rates, but has since expanded its offerings to include international money transfers, becoming a popular choice for individuals and businesses worldwide.

XE became a subsidiary of Euronet Worldwide Inc., a leading provider of electronic financial transaction and payment services, in 2018. This collaboration strengthened XE’s market position and expanded its service offerings.

Today, XE Money Transfer specializes in facilitating safe, quick, and low-cost money transfers. They serve both individuals and businesses, allowing users to send money to over 170 countries in over 130 currencies. XE continues to provide accurate currency exchange rates sourced from live mid-market rates in addition to international money transfers.

In order to help users mitigate currency risk and streamline cross-border payments, the company also provides additional services such as market orders, forward contracts, and tailored business solutions. XE Money Transfer has a solid reputation for offering transparent fees, competitive exchange rates, and dependable transfer services, with a strong focus on customer satisfaction.

XE Money Transfer Key Facts

| Fact/Figure | Details |

|---|---|

| Company Name | XE Money Transfer |

| Founded | 1993 |

| Parent Company | Euronet Worldwide Inc. (since 2018) |

| Headquarters | Newmarket, Ontario, Canada |

| Key People | Beric Farmer (Founder), Steven Dengler (Founder) |

| Services Offered | International Money Transfers, Currency Exchange Rates |

| Supported Countries | Over 170 countries |

| Supported Currencies | Over 130 currencies |

| Transfer Methods | Bank transfers, Online transfers |

| Transfer Speed | 1-4 business days |

| Transaction Limits (individual transactions) | No fixed maximum, minimum limit: $1 or equivalent |

| Transaction Limits (annual) | No fixed maximum, subject to compliance requirements |

| Transfer Fees | No fixed fees, variable fees based on currency/country |

| Exchange Rate Margin | 0.4% – 1.5% depending on currency pairs |

| Customer Support | Phone, Email, Online FAQ |

| Mobile App | Available for iOS and Android |

| Trustpilot Rating | 4.5/5 stars (based on 30,000+ reviews) |

| Official Website | https://www.xe.com/ |

XE Money Transfer Services

XE Money Transfer provides a variety of services to meet the international money transfer requirements of individuals and businesses. Here is a detailed list of the services they offer:

- International Money Transfers: At competitive exchange rates, XE Money Transfer facilitates secure and quick international money transfers. This service is available for both personal and commercial transactions, and users can send money to over 170 countries in over 130 currencies. They accept a variety of transfer methods, including bank transfers and online transfers, with typical transfer times ranging from 1-4 business days. XE Money Transfer is ideal for sending remittances, supporting family members abroad, paying tuition, and conducting international business transactions.

- Currency Exchange Rates: XE is well-known for providing accurate and up-to-date currency exchange rates based on live mid-market rates. This information is available to users via the XE website or mobile app. XE Money Transfer’s money transfer exchange rates are generally competitive, with a margin of 0.4% to 1.5% depending on the currency pairs involved. The company’s exchange rates are transparent, with no hidden markups or fees.

- Market Orders: XE Money Transfer also allows users to set up market orders to take advantage of favorable exchange rates. Users can set a target exchange rate with this service, and when the market reaches that rate, XE will automatically execute the transfer. This feature is especially useful for individuals and businesses looking to reduce currency risk and capitalize on fluctuating foreign exchange markets.

- Forward Contracts: XE Money Transfer offers the option to arrange forward contracts to help users mitigate currency risk and lock in favorable exchange rates. Customers can use this service to lock in a fixed exchange rate for a future money transfer, ensuring stability and predictability in their international transactions. Forward contracts can be especially useful for businesses that make recurring or large cross-border payments because they reduce exposure to exchange rate fluctuations.

- Business Solutions: In addition to personal money transfer services, XE Money Transfer provides tailored business solutions. Risk management strategies, mass payment options, and integration with accounting software are among the solutions offered. This suite of services is intended to help businesses save time and money by streamlining processes and mitigating currency risks when managing international payments.

In summary, XE Money Transfer offers a wide range of services, including international money transfers, currency exchange rates, market orders, forward contracts, and customized business solutions. XE Money Transfer has become a popular choice for individuals and businesses looking for an efficient and dependable way to send money across borders due to its competitive exchange rates, transparent fees, and user-friendly platform.

XE Money Transfer Rates, Costs & Fee Structure

XE Money Transfer takes pride in providing its customers with a transparent and competitive fee structure. While there are no set fees for money transfers, the cost of a transaction is determined by a number of factors, including the currency pair and the destination country. The following is a breakdown of the fees and costs associated with XE Money Transfer:

- Transfer Fees: For its international money transfer services, XE Money Transfer does not charge any fixed fees. Some destination countries and intermediary banks, however, may charge a fee for receiving funds. Fees may vary depending on the currency and country to which you are sending money. It is critical to review the specifics of your transaction to understand any potential fees.

- Margin on Exchange Rate: XE Money Transfer earns money by applying a margin to the exchange rate. Depending on the currency pair involved in the transaction, the margin is typically between 0.4% and 1.5%. XE is forthcoming about its exchange rates, which are based on live mid-market rates. The exchange rate for your transaction will be displayed right away, allowing you to see the exact amount your recipient will receive as well as the cost of the transfer.

- Bank Fees: While XE Money Transfer does not charge fees for sending money, intermediary and recipient banks may. These fees are typically outside of XE Money Transfer’s control and may vary depending on the banks involved. It is critical to check with both your bank and the bank of the recipient to determine any potential fees associated with the transaction.

What Currencies Does XE Money Transfer Support?

XE Money Transfer accepts a diverse range of currencies for international money transfers, meeting the needs of individuals and businesses worldwide. XE Money Transfer supports over 130 currencies and serves over 170 countries as of March 2023.

XE Money Transfer accepts the following major currencies:

- US Dollar (USD)

- Euro (EUR)

- British Pound Sterling (GBP)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

- Swiss Franc (CHF)

- Japanese Yen (JPY)

- South African Rand (ZAR)

- Chinese Yuan Renminbi (CNY)

- Indian Rupee (INR)

- Mexican Peso (MXN)

- Brazilian Real (BRL)

- Hong Kong Dollar (HKD)

- Singapore Dollar (SGD)

This is not an exhaustive list, and XE Money Transfer provides a wide range of other currencies for international money transfers. To find out if a specific currency is supported, go to the XE Money Transfer website or contact their customer service. Please keep in mind that the availability of certain currencies may change over time, and some currencies may have transfer restrictions or special requirements. For the most up-to-date information, always visit the official website.

XE Money Transfer Pros & Cons

| Pros | Cons |

| 1. Competitive Exchange Rates: XE offers competitive exchange rates sourced from live mid-market rates, ensuring users get a fair rate for their transactions. | 1. Exchange Rate Margin: While XE’s rates are generally competitive, they apply a margin of 0.4% – 1.5% depending on the currency pairs, which impacts the final amount received by the recipient. |

| 2. No Fixed Transfer Fees: XE Money Transfer does not charge fixed fees for international transfers, making it an attractive option for cost-conscious users. | 2. Bank Fees: XE does not charge fees for sending money, but intermediary and recipient banks may charge fees for processing transactions. These fees are usually beyond XE’s control and can add to the total cost of the transfer. |

| 4. Speedy Transfers: Transfer speed typically ranges from 1-4 business days, which is faster than many traditional bank transfers. | |

| 5. Market Orders and Forward Contracts: XE offers market orders and forward contracts, allowing users to minimize currency risk and take advantage of favorable exchange rates. |

Is XE Money Transfer Safe?

Yes, XE Money Transfer is a safe and secure international money transfer service. Since its inception in 1993, the company has earned a solid reputation for providing secure and dependable money transfer services. As a subsidiary of Euronet Worldwide Inc., a leading provider of electronic financial transaction and payment services, XE follows stringent security and regulatory standards.

XE Money Transfer employs several key measures to ensure the safety and security of its users’ funds and personal information:

- Regulatory compliance: XE is registered and regulated by the relevant authorities in the countries in which they operate. They are registered with the Financial Crimes Enforcement Network (FinCEN) and licensed as a money transmitter in various states in the United States. XE is registered with the Financial Transactions and Reports Analysis Centre (FINTRAC) in Canada, the Financial Conduct Authority (FCA) regulates them in the United Kingdom, and Australian Securities and Investments Commission (ASIC) in Australia.

- Data security: To protect users’ personal and financial information, XE Money Transfer employs advanced encryption technologies. To ensure the secure transmission of data between the user’s browser and XE’s servers, the company uses Secure Socket Layer (SSL) encryption.

- Fraud detection: To protect users’ funds, the company has strict anti-fraud and anti-money laundering policies in place. To detect and prevent fraudulent activities, XE performs extensive identity verification and transaction monitoring.

- Financial stability: Euronet Worldwide Inc., a reputable and financially stable parent company, backs XE Money Transfer. This affiliation adds to the assurance of the company’s dependability and security.

Overall, XE Money Transfer is a safe and secure international money transfer option. However, as with any financial service, it is critical to stay vigilant and take the necessary precautions to safeguard your personal information and funds.

How Long Do Transfers Take With XE?

XE Money Transfer typically provides transfer times of 1 to 4 business days. The transfer speed is determined by a number of factors, including the currency pair, destination country, and banks involved in the transaction. Transfers may be completed the same day or the next business day in some cases, while others may take slightly longer.

Factors that can affect transfer speeds include:

- Currency pair: Due to local banking systems or regulations, some currencies may require additional processing time.

- Destination country: The banking infrastructure and operating hours of the receiving country can affect transfer speed.

- Banks involved: The processing speed of the sending and receiving banks, as well as any intermediary banks involved, can have an effect on the overall transfer speed.

- Transfer method: XE Money Transfer primarily supports bank transfers, which typically take longer to process than cash pickup or mobile wallet transfers.

- Transaction date and time: Transactions initiated on weekends or public holidays may be delayed because banks do not process transfers on non-working days.

While the typical transfer speed of XE Money Transfer is faster than traditional bank transfers, it may not be the quickest option when compared to other money transfer services that offer instant or near-instant transfers. XE’s competitive exchange rates, no fixed transfer fees, and wide range of supported currencies, on the other hand, make it an appealing choice for many users.

How Does XE Money Transfer Work

Here is a step-by-step guide to signing up for and transferring money with XE Money Transfer:

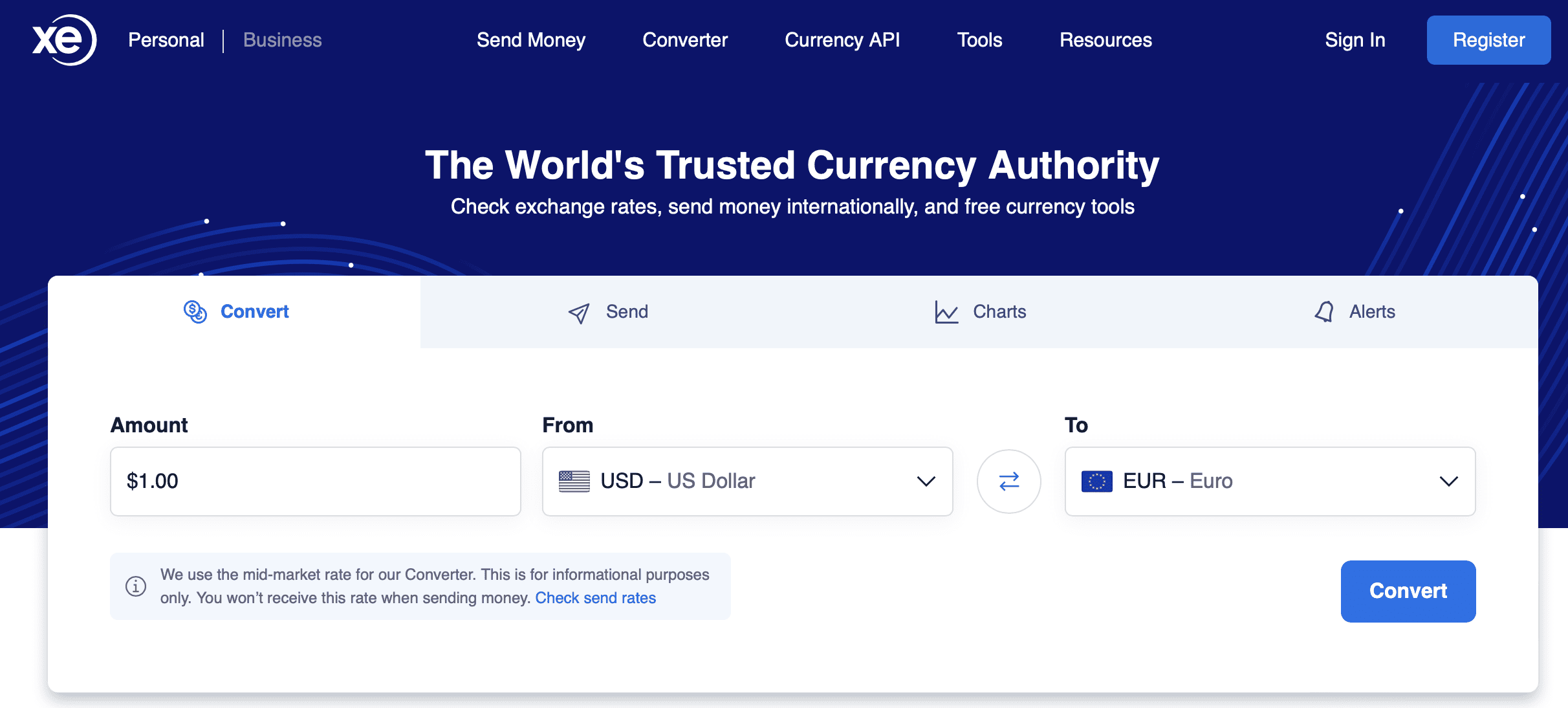

Step 1: First, go to the XE Money Transfer website.

To begin the registration process, go to the XE Money Transfer website (https://www.xe.com/xemoneytransfer) and click on the “Sign Up” or “Get Started” button.

Step 2: Open an account.

Enter your email address, make a password, and select your country of residence. Read and accept the terms and conditions as well as the privacy policy before clicking “Continue.”

Step 3: Confirm your email address.

XE Money Transfer will send you an email with a link for verification. To verify your account, click on the link in the email.

Step 4: Enter your personal information.

Fill in your personal information, such as your full name, birth date, address, and phone number. This information is needed for identity verification as well as compliance with anti-money laundering regulations.

Step 5: Verify your identity.

XE Money Transfer may require additional identity verification depending on your country of residence. A copy of your passport, driver’s license, or national ID card may be required. To complete the identity verification process, follow the instructions on the website.

Step 6: Access your account.

Log in to your XE Money Transfer account using your email and password once your account has been verified.

Step 7: Begin a transfer

To begin a new money transfer, click the “New Transfer” or “Send Money” button. Enter the following information:

- The country of destination

- The currency of the recipient

- The amount you wish to send

Step 8: Request a quote

XE Money Transfer will provide you with a quote for your transfer, which will include the exchange rate as well as any associated fees. Examine the quote and confirm that you are happy with the exchange rate and fees.

Step 9: Fill out the recipient information

Give the recipient’s full name, address, and bank account information (such as account number, bank name, and bank routing number or SWIFT/BIC code). Check this information twice to avoid any delays or errors in the transfer.

Step 10: Select a payment method

Choose a method of payment for your transfer. Because XE Money Transfer primarily supports bank transfers, you must provide your bank account information to fund the transfer. Additional payment options, such as debit or credit cards, may be available in some countries.

Step 11: Confirm the transfer and submit it

Examine all of your transfer’s details, including the exchange rate, fees, recipient information, and payment method. If everything looks good, click “Submit” or “Confirm” to start the transfer.

Step 12: Keep track of your transfer

You will be given a transaction reference number or tracking number by XE Money Transfer. This number can be used to track the progress of your transfer via the website or mobile app.

That’s all! Your funds are now on their way to the intended recipient. Keep in mind that transfer times can vary depending on the currency pair, destination country, and banks involved.

XE Money Transfer Customer Service

XE Money Transfer provides phone and email customer service, as well as an extensive online FAQ section on their website. They offer assistance in a variety of languages, including English, French, and Spanish. However, it is important to note that they do not provide 24/7 live chat support, which may be a disadvantage for users who require immediate assistance outside of business hours.

Here is a rundown of XE Money Transfer’s customer service options:

Phone Support: In several countries, XE Money Transfer has dedicated phone lines for customer support. During normal business hours, you can contact their customer service representatives. The following are some local phone numbers:

- USA: +1 877 932 6640

- UK: +44 1553 611 499

- Canada: +1 416 642 6595

- Australia: +61 2 8270 4500

- New Zealand: +64 (0) 9 905 4660

Email Support: If you prefer to contact XE Money Transfer by email, send your message to [email protected]. Email inquiries are typically responded to within 24 to 48 hours by their customer support team.

Online FAQ Section: XE Money Transfer’s website includes a comprehensive FAQ section that covers a wide range of topics, including account registration, the transfer process, fees, exchange rates, and more. You can use this resource at any time to find answers to frequently asked questions and issues.

While XE Money Transfer offers a variety of customer support channels, it is important to be aware of their limitations, such as the lack of 24/7 live chat support. Nonetheless, their phone and email support options, as well as the extensive FAQ section, should adequately address the majority of user inquiries and concerns.

Recent Positive Online XE Reviews

Excelent Since last few years I have join XE.com I found very satisfied with their fast service delivered right on time into your accounts. Very straight forward and simple to use and safe. Also you could check your past history payment up to date.

From Jit Dhami on 31/12/22

This was really excellent, simple, and easy. There’s nowhere else that I could find a decent, much less free!!, international transfer fee to send funds to Europe. I’m mesmerized by how this service could be possible.

From NJ on 12/03/23

I was worried about transferring money to Spain, as it was my first time doing this , XE were true to their word ,quick and efficient, and euros were transferred within an hour

From Maggs Hitchen on 14/03/23

A very easy experience with XE. Used the service to make a small payment in EUR to a EUR account based in the UK. Needed some help from the webchat advisor but after that it was all very smooth. XE also kept me updated on the status of the transfer throughout. Very happy to use again.

From Ramen on 02/03/23

Recent Negative Online XE Reviews

Very bad application so slow, no response during weekends!! My husband and I made a transfer and none of them were added to our bank accounts!! Never use again!!

From Mizra Mirzati on 09/03/23

So used to use this service regularly. Then stopped for about a year. Found my account was closed no reason given. Opened new account but money transfer method had changed. Details for bank transfer did not include all fields for an NZ to NZ account to send to XE so the money could be then transferred overseas. I asked the chat and they had no idea. I rang a local NZ person and they had no idea. Just resent useless information. I replied with a screen dump of what I was asking for got no reply.

From Karen Elfick on 08/03/23

XE Money Transfer Alternatives

Here we compare XE against a few of their popular direct companions to see how they rate.

XE vs. Currencies Direct

| Feature | XE Money Transfer | Currencies Direct |

|---|---|---|

| Exchange Rates | Competitive rates with a margin of 0.2% to 1.5% | Competitive rates with a margin 0.4% to 1.4% |

| Transfer Fees | No fixed transfer fees, fees vary by destination | No transfer fees for most transactions |

| Transfer Speed | 1 to 4 business days | 1 to 2 business days for most transfers |

| Supported Currencies and Countries | Over 170 countries and more than 130 currencies | Over 120 currencies and over 40 destination countries |

| Transfer Methods | Bank transfers and online transfers | Bank transfers and online transfers |

| Transfer Limits | Minimum: $1 or equivalent; No fixed maximum limits | Minimum: £100 or equivalent; No fixed maximum limits |

| Registration Process | Online registration with identity verification | Online registration with identity verification |

| Online Platform and Mobile App | User-friendly website and mobile app (iOS & Android) | User-friendly website and mobile app (iOS & Android) |

| Customer Support | Phone, email, and online FAQ section | Phone, email, and online FAQ section |

| Additional Services | Market orders, forward contracts, business solutions | Spot contracts, forward contracts, limit orders, and tailored business solutions |

| Trustpilot Rating (as of March 2023) | 4.2 out of 5 stars (Great) | 4.9 out of 5 stars (Excellent) |

| Languages Supported | English, French, Spanish | English, Spanish, French, Italian, Portuguese, Chinese, Japanese, Arabic, and others |

| API Integration | Available for businesses | Available for businesses |

| Regular Payment Plans | Not available | Available |

| Hedging Tools | Forward contracts | Forward contracts and limit orders |

| Personal Account Manager | Available | Available |

| Rate Alerts | Available | Available |

| Multi-currency Accounts | Not available | Available |

| Security and Regulation | Regulated by FCA, FinCEN, and FINTRAC | Regulated by FCA |

| Business Solutions | Risk management, batch payments, and API integration | Risk management, batch payments, mass payouts, API integration, and bespoke currency solution |

For more details you can read our comprehensive review of Currencies Direct.

XE vs. OFX

| Feature | XE Money Transfer | OFX |

|---|---|---|

| Exchange Rates | Competitive rates with a margin of 0.2% to 1.5% | Competitive rates with a margin of 0.5% to 2% |

| Transfer Fees | No fixed transfer fees, fees vary by destination | No transfer fees for most transactions |

| Transfer Speed | 1 to 4 business days | 1 to 4 business days for most transfers |

| Supported Currencies and Countries | Over 170 countries and more than 130 currencies | Over 55 currencies and over 190 destination countries |

| Transfer Methods | Bank transfers and online transfers | Bank transfers and online transfers |

| Transfer Limits | Minimum: $1 or equivalent; No fixed maximum limits | Minimum: $1,000 or equivalent; No fixed maximum limits |

| Registration Process | Online registration with identity verification | Online registration with identity verification |

| Online Platform and Mobile App | User-friendly website and mobile app (iOS & Android) | User-friendly website and mobile app (iOS & Android) |

| Customer Support | Phone, email, and online FAQ section | Phone, email, and online FAQ section |

| Additional Services | Market orders, forward contracts, business solutions | Spot contracts, forward contracts, limit orders, and tailored business solutions |

| Trustpilot Rating (as of March 2023) | 4.2 out of 5 stars (Great) | 4.2 out of 5 stars (Great) |

| Languages Supported | English, French, Spanish | English, Spanish, French, German, Italian, Chinese, Japanese, and others |

| API Integration | Available for businesses | Available for businesses |

| Regular Payment Plans | Not available | Available |

| Hedging Tools | Forward contracts | Forward contracts and limit orders |

| Personal Account Manager | Available | Available |

| Rate Alerts | Available | Available |

| Multi-currency Accounts | Not available | Available |

| Security and Regulation | Regulated by FCA, FinCEN, and FINTRAC | Regulated by ASIC, FCA, FINTRAC, and FinCEN |

| Business Solutions | Risk management, batch payments, and API integration | Risk management, batch payments, mass payouts, API integration, and bespoke currency solutions |

XE vs. Wise

| Feature | XE Money Transfer | Wise (formerly TransferWise) |

|---|---|---|

| Exchange Rates | Competitive rates with a margin of 0.2% to 1.5% | Mid-market rates with no added margin |

| Transfer Fees | No fixed transfer fees, fees vary by destination | Percentage-based fees, varies by amount and currency |

| Transfer Speed | 1 to 4 business days | Usually within 1-2 business days |

| Supported Currencies and Countries | Over 170 countries and more than 130 currencies | Over 50 currencies and over 80 destination countries |

| Transfer Methods | Bank transfers and online transfers | Bank transfers, debit/credit card, and online transfers |

| Transfer Limits | Minimum: $1 or equivalent; No fixed maximum limits | Minimum: $1 or equivalent; Maximum varies by currency and destination |

| Registration Process | Online registration with identity verification | Online registration with identity verification |

| Online Platform and Mobile App | User-friendly website and mobile app (iOS & Android) | User-friendly website and mobile app (iOS & Android) |

| Customer Support | Phone, email, and online FAQ section | Phone, email, and live chat support |

| Additional Services | Market orders, forward contracts, business solutions | Multi-currency accounts, business solutions |

| Trustpilot Rating (as of September 2021) | 4.3 out of 5 stars (Excellent) | 4.6 out of 5 stars (Excellent) |

| Languages Supported | English, French, Spanish | English, Spanish, French, Italian, Portuguese, Dutch, and others |

| API Integration | Available for businesses | Available for businesses |

| Regular Payment Plans | Not available | Not available |

| Hedging Tools | Forward contracts | Not available |

| Personal Account Manager | Available | Not available |

| Rate Alerts | Available | Not available |

| Multi-currency Accounts | Not available | Available |

| Security and Regulation | Regulated by FCA, FinCEN, and FINTRAC | Regulated by FCA, FinCEN, ASIC, and other regulators |

| Business Solutions | Risk management, batch payments, and API integration | Batch payments, API integration, and invoicing solutions |

XE vs. TorFX

| Feature | XE Money Transfer | TorFX |

|---|---|---|

| Exchange Rates | Competitive rates with a margin of 0.2% to 1.5% | Competitive rates with a margin of 1% to 2% |

| Transfer Fees | No fixed transfer fees, fees vary by destination | No transfer fees |

| Transfer Speed | 1 to 4 business days | 1 to 2 business days for most transfers |

| Supported Currencies and Countries | Over 170 countries and more than 130 currencies | Over 60 currencies and over 120 destination countries |

| Transfer Methods | Bank transfers and online transfers | Bank transfers and online transfers |

| Transfer Limits | Minimum: $1 or equivalent; No fixed maximum limits | Minimum: £100 or equivalent; No fixed maximum limits |

| Registration Process | Online registration with identity verification | Online registration with identity verification |

| Online Platform and Mobile App | User-friendly website and mobile app (iOS & Android) | User-friendly website; No mobile app |

| Customer Support | Phone, email, and online FAQ section | Phone, email, and online FAQ section |

| Additional Services | Market orders, forward contracts, business solutions | Spot contracts, forward contracts, limit orders, and tailored business solutions |

| Trustpilot Rating (as of September 2021) | 4.3 out of 5 stars (Excellent) | 4.7 out of 5 stars (Excellent) |

| Languages Supported | English, French, Spanish | English, Spanish, French, German, and others |

| API Integration | Available for businesses | Not available |

| Regular Payment Plans | Not available | Available |

| Hedging Tools | Forward contracts | Forward contracts and limit orders |

| Personal Account Manager | Available | Available |

| Rate Alerts | Available | Available |

| Multi-currency Accounts | Not available | Not available |

| Security and Regulation | Regulated by FCA, FinCEN, and FINTRAC | Regulated by FCA and ASIC |

| Business Solutions | Risk management, batch payments, and API integration | Risk management, batch payments, mass payouts, and bespoke currency solutions |

Read our comprehensive review of TorFX.

Conclusion

To summarize, XE Money Transfer is a dependable and cost-effective option for individuals and businesses looking to send money internationally. XE meets a wide range of money transfer needs by offering competitive exchange rates, no fixed transfer fees, and support for over 130 currencies and 170 countries. Furthermore, the platform’s user-friendly website and mobile app, as well as their various business solutions, make it versatile and simple to use.

However, some limitations of XE Money Transfer must be considered, such as the added margin on exchange rates, varying transfer fees, and the absence of some services, such as multi-currency accounts and regular payment plans. Furthermore, transfer speeds may be slower than those of competitors, and live chat support is not available.

Overall, XE Money Transfer is a solid option for money transfers, particularly for those who value competitive rates and a wide range of supported currencies and countries. When selecting a money transfer service, it is critical to compare different providers and consider your specific needs and preferences.

Frequently Asked Questions

Is XE Money Transfer Legitimate?

Yes, XE Money Transfer is a legitimate company that provides currency exchange and international money transfer services. XE is a subsidiary of Euronet Worldwide, a publicly traded company that is regulated by multiple financial authorities around the world. XE has been in business since 1993 and has a good reputation in the industry. However, as with any financial service provider, it’s important to do your own research and due diligence before using their services, and to ensure that you fully understand any fees or charges associated with their service.

Who Owns XE Money Transfer?

XE Money Transfer is a subsidiary of Euronet Worldwide, Inc., a publicly traded company based in the United States. Euronet Worldwide is a leading global provider of payment and transaction processing solutions, operating in more than 50 countries worldwide. The company was founded in 1994 and is headquartered in Leawood, Kansas. Euronet Worldwide also owns other financial services brands, including Ria Money Transfer, HiFX, and CFSB.

Is XE Money Transfer Free?

XE Money Transfer is not completely free. While they do not charge a transaction fee for their service, they do make money by offering a currency exchange rate that includes a markup or spread, which is how they generate their revenue. The exchange rate offered by XE will generally be lower than the mid-market exchange rate, which is the rate that you would find on independent currency exchange websites. It’s important to keep in mind that the exchange rate you receive may vary depending on the currency pair and the amount you are transferring. Additionally, your bank or the recipient’s bank may charge additional fees for the transfer. It’s always a good idea to compare different money transfer services and carefully read the terms and conditions to understand the fees and exchange rates involved.

Is XE Money Transfer Instant?

XE Money Transfer is generally not an instant transfer service, but the transfer time can vary depending on several factors, including the currencies involved, the amount being transferred, and the processing times of the banks involved. Typically, XE Money Transfer processes the transfer within one to four business days of receiving your payment, and then the funds are sent to the recipient’s bank account, which can take an additional one to four business days to be credited. However, XE offers faster transfer options for certain currency pairs, including same-day and next-day transfers, for an additional fee. It’s important to note that the processing time can also be affected by weekends, public holidays, and bank-specific processing times. Before making a transfer, it’s always a good idea to check the estimated transfer time and any applicable fees.